The Proliferation of Cryptocurrency Scams

With the allure of digital assets comes a variety of scams, ranging from classic tricks to novel methods exploiting the unique nature of cryptocurrencies.

The Unavoidable Wave of Scams in the Crypto Realm

Just like traditional money, cryptocurrency is not immune to the clutches of scammers. The past years have witnessed substantial financial losses due to these fraudulent activities. For instance, the Wormhole cryptocurrency platform suffered a staggering $320 million loss in February 2022 due to a cyberattack. Adding to this, more than $1 billion has been swindled by cryptocurrency scammers since 2021, as per a Federal Trade Commission report.

In the UK, Lloyds Banking Group observed a 23% surge in cryptocurrency scams in 2023 compared to 2022. While there was a decline in the first half of 2023, a significant increase was noted in the third quarter, highlighted by the Mixin hack where nearly $200 million was stolen.

Digital Currency vs. Cryptocurrency

Cryptocurrencies, such as Bitcoin, differ from digital currencies in their use of blockchain technology and lack of a centralized authority, making them more challenging to recover from theft.

Common Cryptocurrency Scams to Be Wary Of

- Bitcoin Investment Schemes: These scams involve impostors posing as investment gurus, promising hefty returns in exchange for upfront fees. Additionally, they might exploit personal information under the guise of fund transfers.

- Rug Pull Scams: These involve hyping up a cryptocurrency project or NFT, then vanishing with the invested money. A notorious example is the Squid coin scam, which left investors with worthless tokens.

- Romance Scams on Dating Apps: Online relationships are exploited to trick individuals into cryptocurrency transactions, after which the scammer disappears.

- Phishing Scams: A long-standing method where scammers use fake websites to harvest private information like wallet keys.

- Man-in-the-Middle Attacks: Public Wi-Fi networks are a breeding ground for these attacks, where sensitive information is intercepted.

- Social Media Giveaway Scams: Fraudulent posts and fake celebrity accounts are used to lure people into making payments under the guise of giveaways.

- Ponzi Schemes: These scams involve paying old investors with funds from new ones, under the promise of high returns with minimal risk.

- Fake Cryptocurrency Exchanges: Investors are drawn to non-existent exchanges, often realizing the fraud only after losing their deposits.

- Employment Scams and Shadow Workforces: These involve fake recruitment offers requiring cryptocurrency payments or North Korean IT workers infiltrating companies to facilitate cyber theft.

- Flash Loan Attacks: These involve exploiting uncollateralized loans to manipulate market prices for profit, as seen in the Platypus Finance incident.

- AI-Driven Scams: Advanced technology is used to create convincing fake endorsements and investment opportunities, often involving deepfakes of celebrities.

Protecting Your Digital Assets

Red Flags and Safety Measures

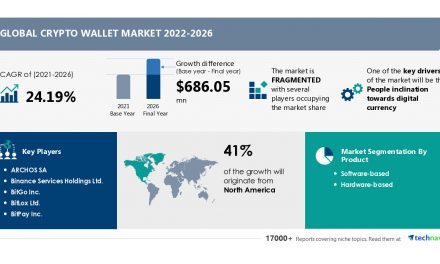

Be vigilant for promises of unrealistic gains, demands for cryptocurrency payments, and manipulation tactics. Strong passwords, secured connections, and choosing between digital and hardware wallets are crucial. Remember, cryptocurrencies are not FDIC insured, making safeguarding them essential.

Reporting Cryptocurrency Scams

Victims of cryptocurrency fraud should promptly report to relevant authorities like the CFTC, FTC, IC3, and the SEC, as well as the involved cryptocurrency exchange.

In summary, staying informed and cautious is key to navigating the cryptocurrency landscape safely amidst the prevalence of scams.