In the world of cryptocurrency trading, shifts are often dramatic and instantaneous. Recent data, however, shows a significant and sustained decrease in trading volume on the popular Robinhood platform. With a severe dip from the previous year, the renowned mobile application is struggling to maintain its standing in the dynamic cryptocurrency market.

The Ebbing Tide: Robinhood’s Cryptocurrency Trading Volume

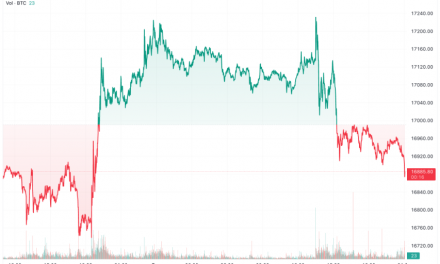

May 2023 proved to be a testing time for Robinhood. Their cryptocurrency trading volume crashed to a low of $2.1 billion, marking a precipitous 68% drop year-over-year. This slump has raised eyebrows in the investment community and sparked crucial conversations about the volatile nature of the cryptocurrency landscape.

Dissecting the Decline: Factors Influencing the Decrease

While the cryptocurrency market has always been subject to volatility, Robinhood’s recent performance is surprisingly downbeat. The sharp decline can be attributed to a number of factors, not least the increasing competition in the cryptocurrency exchange market, contributing to Robinhood’s dwindling share.

Another important element is the diminished investor interest in the wake of severe market corrections, as well as increased regulatory scrutiny and the potential for stiffer regulation in the future.

Competing Platforms: The New Titans of Crypto Trading

Competition in the cryptocurrency exchange market has intensified over the years. Proliferating platforms such as Binance, Coinbase, and eToro have all been expanding their user bases, offering more variety in their portfolios, and enhancing their user experience.

While Robinhood still holds a considerable customer base, these newer platforms’ aggressive strategies and robust offerings are chipping away at Robinhood’s market share.

Investor Sentiment: Fear, Uncertainty, and Doubt

The cryptocurrency world is not for the faint of heart. The rollercoaster ride of crypto prices in recent years has conditioned investors to be wary. 2023, in particular, has been a year of market corrections, causing an increased level of Fear, Uncertainty, and Doubt (FUD) among investors.

Robinhood, being primarily a retail investor platform, has felt the brunt of this sentiment more than its competitors, who have a more diversified user base. This has contributed significantly to the drop in their crypto trading volume.

Robinhood’s Response: Navigating the Downturn

Despite the challenging conditions, Robinhood has been taking strategic steps to mitigate the downturn. Plans for launching a new wallet feature and expanding its crypto offerings indicate that the platform is not going down without a fight.

While the coming months will reveal the effectiveness of these measures, Robinhood’s journey will continue to be a compelling watch in the evolving world of cryptocurrency trading.

Robinhood’s struggle and resilience highlight the complex dynamics of the crypto market. It serves as a testament to the unforgiving volatility of digital currencies, reinforcing the need for vigilance, strategic innovation, and adaptability for survival in this challenging landscape.