The Rising Tide of AI in the Stock Market

The previous year’s Wall Street success story was largely attributed to the artificial intelligence (AI) sector, a key driver in the Nasdaq Composite’s remarkable 43% surge in 2023. With the AI stock market expected to grow at a compound annual growth rate (CAGR) of 37% through 2030, reaching a valuation of over $1 trillion, the potential for AI stocks like Nvidia and Intel is immense. This analysis delves into whether Nvidia, an established player, or Intel, a relative newcomer in AI, presents a better investment opportunity this January.

Nvidia: The Reigning Champion in AI

Nvidia experienced a meteoric rise in 2023, with a 245% increase in its stock value since the previous January. This success is rooted in Nvidia’s long-standing dominance in the graphics processing unit (GPU) market, which has seamlessly transitioned into AI dominance. The company’s fiscal 2024 third-quarter results were staggering, with a 206% increase in revenue and a 1,600% rise in operating income, driven primarily by a 279% jump in data center revenue.

Despite upcoming challenges from AMD and Intel in the GPU sector, Nvidia’s considerable lead and the expanding AI market position it favorably for continued dominance.

Intel: Overcoming Challenges and Embracing AI

In contrast, Intel has faced significant hurdles in recent years, evidenced by declining revenue, operating income, and free cash flow since 2020. The company’s challenges included the end of a long-term partnership with Apple and losing CPU market share to AMD. However, Intel’s recent forays into the desktop GPU market and the announcement of new AI chips signify a potential turnaround.

Intel’s financial recovery appears to be underway, with a 43% increase in operating income in Q3 2023 and a notable improvement in its data center and AI segment. These developments hint at a promising future for Intel in the AI landscape.

Top AI Stock Comparative Analysis: Nvidia vs. Intel as AI Investments

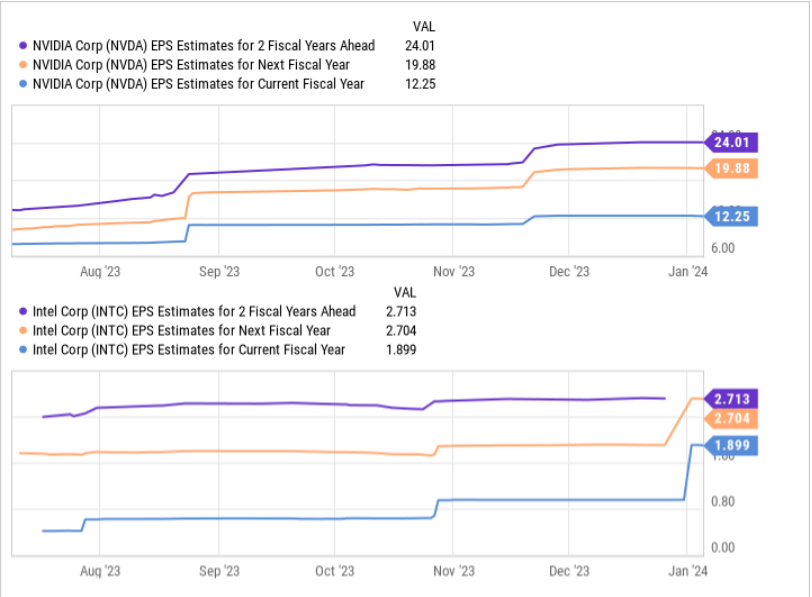

Image Source: The Motly Fool / Data: Jan 08 2024, 11:56 AM EST /Powered by YCHARTS

When it comes to choosing the superior AI investment, earnings per share (EPS) estimates play a crucial role. Forecasts indicate Nvidia could reach $24 per share over the next two fiscal years, while Intel might achieve nearly $3 per share. Based on their forward price-to-earnings ratios, Nvidia’s stock is projected to surge by 96%, while Intel could see a 42% increase.

Nvidia’s robust position in the AI market and its extraordinary projected growth make it an attractive investment option. Intel, while showing signs of recovery and promise, still trails behind in terms of immediate growth potential in the AI space.

Conclusion

Considering the current trends and projections, Nvidia emerges as the standout choice for investors looking to capitalize on the burgeoning AI market. Its established dominance, coupled with impressive growth forecasts, positions Nvidia as a more compelling investment than Intel in the AI sector. While Intel shows potential, Nvidia’s current standing and future prospects make it a more attractive option for those seeking exposure to AI stocks.