Prepare to be astounded by the forthcoming growth of the non-fungible token (NFT) market, which is projected to witness a monumental surge of USD 113,933.5 million from 2022 to 2027. This remarkable market expansion will be propelled by a staggering compound annual growth rate (CAGR) of 35.02% during the forecast period.

Non-fungible Token (NFT) Market: A Kaleidoscope of Vendors

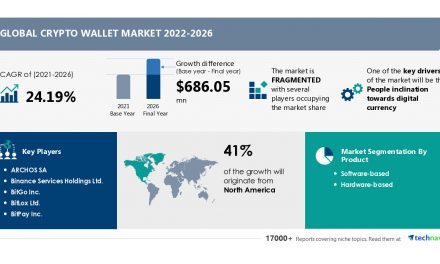

Delving into the landscape of the global non-fungible token (NFT) market reveals a captivating assortment of both global and regional vendors. Among the prominent players offering non-fungible tokens (NFTs) in this dynamic market are Binance Services Holdings Ltd., Cloudflare Inc, Dapper Labs Inc., Decentraland, Enjin Pte. Ltd., Foundation Labs Inc., FTX Trading Ltd., Funko Inc., Gala Games, Gemini Trust Co. LLC, Mintable.app, Mobox Digital Co. Ltd., Onchain Labs Inc., OpenSea, Rarible Inc., Sorare, SuperRare Labs Inc., Theta Labs Inc., Yellowheart LLC, Yuga Labs LLC, and numerous others.

Unraveling the Non-fungible Token (NFT) Market – An In-depth Analysis of Segmentation

Embark on a comprehensive journey through the market segmentation of non-fungible tokens (NFTs), which encompasses a wide array of applications such as collectibles, sports, arts, and more, catering to both personal and commercial end-users. Geographically, the market encompasses APAC, North America, South America, Europe, and the Middle East and Africa, each playing a distinctive role in shaping the global non-fungible token (NFT) market.

Within this vibrant market tapestry, the collectibles segment emerges as a beacon of growth during the forecast period. NFT collectibles, often referred to as limited edition or rare NFT tokens minted on the blockchain, boast a unique characteristic—they cannot be exchanged or traded for other collectibles. Noteworthy vendors such as Funko Inc., Foundation, and Makerspace offer an online trading platform for NFT collectibles, fueling the rising demand for digital assets and, in turn, propelling the market’s growth trajectory.

Geographical Mosaic

Zooming in on the geographical aspect, the global non-fungible token (NFT) market reveals its diverse hues across APAC, North America, South America, Europe, the Middle East, and Africa. With APAC projected to secure a 39% market share by 2023, the region emerges as a powerful catalyst for market expansion. The burgeoning demand for digital assets in countries such as Singapore, China, South Korea, the Philippines, and Japan contributes significantly to the thriving NFT market in APAC. Notably, various retail channels in Korea are actively venturing into the flourishing NFT business by retailing art and fashion items. For instance, in January 2022, CJ OliveNetworks Co. Ltd., a subsidiary of South Korea-based CJ Corp., unveiled its collaboration with domestic blockchain company Galaxia Metaverse to sell NFT artworks. Such developments are poised to drive the market’s growth throughout the forecast period.

The Dynamics of the Non-fungible Token (NFT) Market

Now, let us delve into the driving forces, key trends, and major challenges that shape the landscape of the non-fungible token (NFT) market.

Driving the Market Forward

A relentless surge in the demand for digital art serves as the primary driving force behind the market’s growth during the forecast period. Digital art encompasses visually captivating creations generated with the aid of computers. The popularity of NFTs in digital art applications across the internet, social media platforms, and other digital mediums continues to soar. A defining feature of NFTs lies in their ability to link digital artwork to a token, enabling artists and owners to establish preferred prices for their NFT artworks. NFTs offer a host of enticing characteristics, including the sale of limited edition tokens through virtual platforms, effectively reducing the turnaround time for purchases. Thus, these factors are poised to propel market growth in the foreseeable future.

Emerging Trends

One noteworthy trend gripping the market is the introduction of fractionalized NFTs. This pioneering concept involves dividing the ownership of an NFT among multiple individuals. As NFTs gain further traction across the web, the prices associated with these digital assets are expected to rise. Fractionalization of NFTs facilitates democratized ownership, ensuring consistent market activity even as bidding prices escalate. This approach allows more individuals to partake in the bidding process, thereby fueling market growth throughout the forecast period.

Overcoming Challenges

Uncertainty surrounding NFT demand and pricing poses a significant challenge to market growth. Assessing the future value of NFTs remains a complex endeavor for potential buyers. Various factors, such as scarcity, uniqueness, buyer and owner perceptions, as well as the availability of distribution channels, influence the valuation of NFTs. Consequently, new buyers entering the NFT market face the formidable challenge of discerning the identity of future NFT buyers and the potential factors that might influence their purchasing decisions. Thus, such factors are expected to impede market growth in the coming years.