Bitcoin and ether momentum stalled this week as investors fretted first about vibrant jobs data and continued U.S. central bank hawkishness, and then about the potential for increased crypto regulation. Kraken’s agreement to sunset liquidity staking services for U.S. customers particularly darkened the market mood late Thursday.

Bitcoin and ether dropped 6.8% and 7.3% over the last seven days, respectively, losing a sizable chunk of their gains from the first five weeks of 2023. Both are now up about 30% year to date – spearheads in a wider crypto revival – although this week’s declines supported a number of analysts who have predicted that bitcoin support will sink to the $20,000 level.

The week also marked cryptos’ decoupling from traditional finance indexes, with the correlation between bitcoin and the S&P 500 falling more than 50%. Many leading digital assets spent much of the week in the red.

Top performers

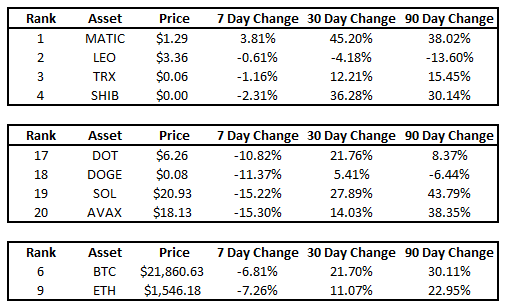

Among the top 20 cryptocurrencies by market capitalization, excluding stablecoins, only Polygon’s MATIC finished the week in positive territory. BTC and ETH ranked sixth and ninth, respectively.

Solana (SOL) and avalanche (AVAX) were the weekly laggards, with both down more than 15%. The large number of declining assets sharply contrasts to the prior week, when 16 of the 20 assets finished higher.

Crypto seven-day performance (Messari)

While the macro narrative has dominated crypto markets for much of 2023, industry-specific developments assumed center stage starting late Wednesday and culminating Thursday with Kraken’s agreement to settle Securities and Exchange Commission (SEC) charges that its staking services for U.S. retail investors amounted to offering unregistered securities. Along with halting the offering, Kraken will pay a $30 million fine.

SEC Chairman Gary Gensler’s warning for crypto companies to “take note” and “fall into compliance” following the Kraken announcement presented a larger, long-reaching overhang for the industry. The statement clearly signaled the SEC will be stepping up its crypto regulatory efforts.

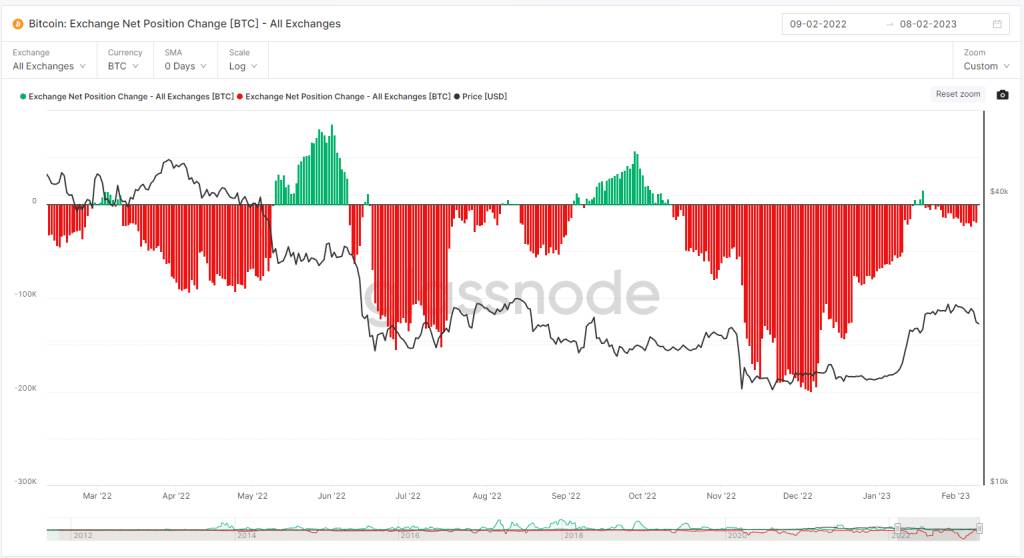

The risks to crypto markets appear to be shifting from all-encompassing systematic risk to sector-specific nonsystematic risk, and investors should monitor the flow of coins to and from exchanges for bullish and bearish signals.

The Exchange Net Position change for BTC has been negative this week, implying that investors are transferring coins from exchanges into storage (bullish). A shift in this trend, however, would indicate that investors are becoming leery of BTC’s immediate prospects and sending coins to exchanges to be sold (bearish).

Bitcoin net exchange flow (Glassnode)

Source: CoinDesk