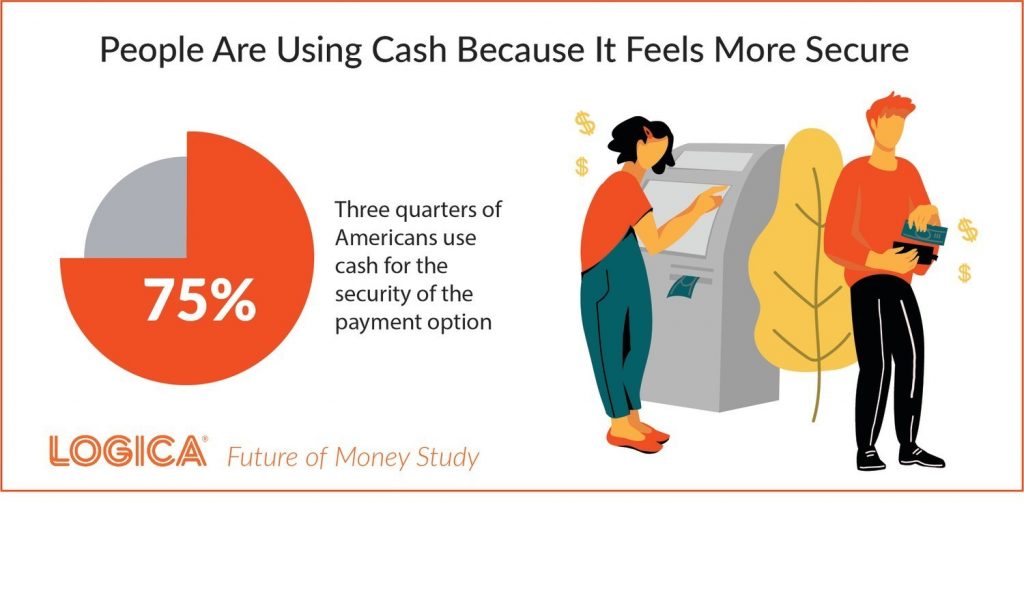

SAN FRANCISCO – The newest Future of Money Study from Logica Research continues an examination of past, current and future financial trends—providing data that allows brands to make decisions to drive growth, develop products and services, and reach customers. This newest wave of the study includes highlights on working, payments and money management, as well as a deep dive into generational financial trends and a special report on Cryptocurrency.

Some highlights from the findings include:

- Forty-four percent (44%) of Americans report that they are spending less in the current economy.

- Seventy-five percent (75%) of Americans feel it is important that employers offer programs to help them manage their finances.

- Gen Z is saving more than other generations in the current economy (51%).

- Barriers to owning Cryptocurrency include the perception that it is too risky (44%), don’t know how to invest in it (19%), and lack of information from trusted sources (13%).

Cryptocurrency Trends, Generational Financial Profiles, and New Data on Payments Uncovered in New Report From Logica Research

The study, ongoing since 2017, is a comprehensive look at the current consumer money mindset in the United States, and covers specifics about how people are making, spending, investing and engaging with financial brands. In addition to the generational financial personas and the special report on Cryptocurrency, the full study includes new data and trend analysis of how companies can support employee financial well-being, the latest on payments like cash usage and digital options, and where consumers are looking for financial advice and guidance.

“Today’s quickly evolving financial landscape means that businesses need to understand the latest trends to reach their customers, and shape strategy for their services, products and experiences,” said Lilah Raynor, CEO & Founder, Logica Research. “This highlight report gives a quick hit into some top trends, with the full Insights Kit providing in-depth insights to help companies succeed in all aspects of the financial world.”

Source: Logica