Bitcoin (BTC): The largest cryptocurrency by market value was recently trading at $23,100, up 0.4% in the past 24 hours, as traders awaited next week’s Federal Open Market Committee decision on interest rates. BTC has rallied almost 40% since Jan. 1, on track for its best opening to a year since 2013 when it surged 51%.

Equities closed up as traders processed the latest Personal Consumption Expenditures (PCE) report, which showed a slowdown in inflation at the end of last year. The tech-heavy Nasdaq Composite rose 0.95%, while the S&P 500 and the Dow Jones Industrial Average (DJIA) were up 0.25% and 0.08%, respectively.

Top Story

Four senior Biden administration officials published a statement on Friday urging Congress to “step up its efforts” with respect to regulating the cryptocurrency market.

-

The officials – Brian Deese, director of the National Economic Council; Arati Prabhakar, director of the White House Office of Science and Technology Policy; Cecilia Rouse, chair of the Council of Economic Advisors; and National Security Advisor Jake Sullivan – wrote that Congress “should expand regulators’ powers to prevent misuses of customers’ assets … and to mitigate conflicts of interest.”

-

Other suggestions for Congress in the statement included strengthening transparency and disclosure requirements for crypto companies, strengthening penalties for violations of illicit-finance rules and working more closely with international law enforcement partners.

-

The officials also made suggestions about what Congress should not do in terms of crafting new crypto regulation, including “greenlight[ing] mainstream institutions, like pension funds, to dive headlong into cryptocurrency markets.”

-

To do so, the officials warned, “would be a grave mistake” that “deepens ties between cryptocurrencies and the broader financial system.”

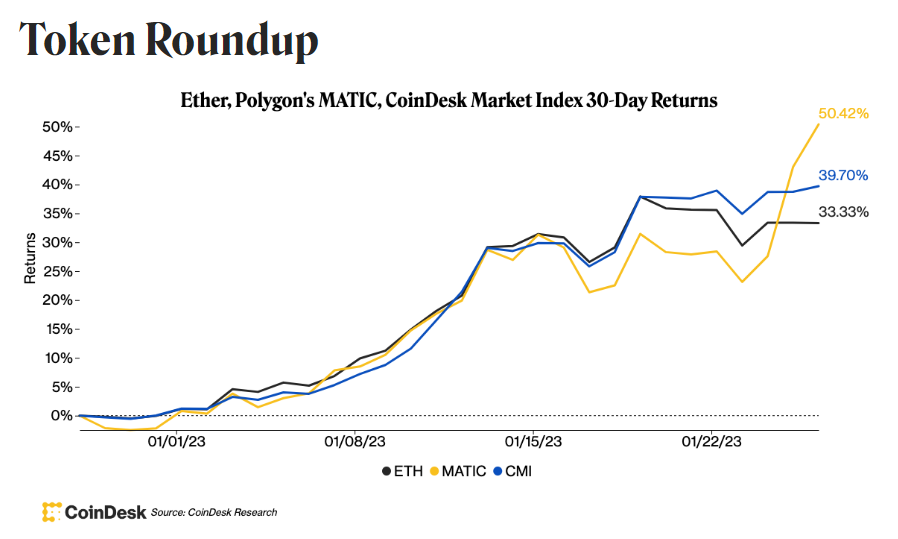

Ether (ETH): ETH was up 0.2% to recently trade at $1,600.

Polygon (MATIC): The MATIC token recently rose 8% to $1.1 Friday. Its price has been up 55% since Dec. 31 amid a spike in daily transactions.

Gains Network (GNS): The native token of decentralized exchange gained more than 7% to trade at $6.20 Friday, according to data from CoinGecko. Gains Network has recorded over $1.5 billion in trading volume on the Arbitrum blockchain nearly a month after being deployed.

Vela Exchange (DXP): The utility token of the Arbitrum-based decentralized trading platform recently gained some 50% Friday as the project prepares to release its much-anticipated beta version next week. DXP had settled back to a 26% advance, trading around $2.20 as of publication time, according to data from CoinGecko.

Source: CoinDesk