Decline in BUSD Demand and Market Cap

Binance USD (BUSD), the stablecoin backed by Paxos and affiliated with the world’s largest cryptocurrency exchange, has experienced a decline in market capitalization. According to CoinGecko data, BUSD’s market cap fell below $10 billion on Friday for the first time since June 2021. This dip in market capitalization can be attributed to a decrease in demand for BUSD after Paxos stopped issuing new tokens in response to regulatory orders from the New York Department of Financial Services. The SEC is also reportedly preparing to sue Paxos for offering unregistered securities. As a result, BUSD investors have redeemed approximately $6.7 billion of tokens from Paxos.

Concerns Over BUSD Liquidity

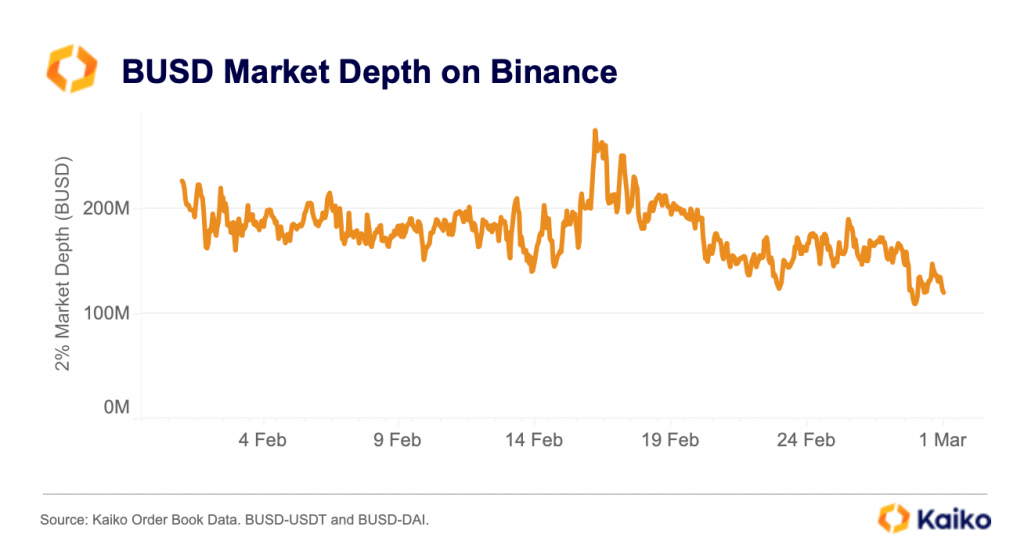

Coinbase, the US-based cryptocurrency exchange, announced that it would halt BUSD trading on its platform beginning March 13 due to liquidity concerns. According to Kaiko, a crypto market research firm, BUSD’s daily trading volume on Coinbase was approximately $9 million over the past two months, with market depth within 2% of the market price being just $600,000. This lack of liquidity makes BUSD’s price susceptible to volatility, and its daily trading volume has caused DOGE to replace BUSD as the ninth-largest cryptocurrency by market capitalization. Additionally, BUSD’s liquidity on Binance, its main market, has significantly deteriorated in recent months.

Source: CoinDesk