Covina – Blockchain is a data storage method that makes changing the data difficult or impossible. A blockchain is a digital ledger of transactions that is duplicated and distributed across the network of computer systems that comprise the blockchain. Blockchain technology will result in significant efficiency gains, cost savings, transparency, faster payouts, and fraud mitigation by allowing data to be shared in real-time between various parties in a trusted and traceable manner. Furthermore, insurance companies operate in a highly competitive environment where both retail and corporate customers expect the best value for money and the best online experience. In the insurance industry, blockchain technology represents an opportunity for positive change and growth. As a result, the increased demand for blockchain in insurance is expected to boost the market. The growing number of fraudulent insurance claims, as well as the belief that smart contracts will hold a significant market share, are expected to drive market growth. Furthermore, the growing need to reduce total cost of ownership drives market growth. However, the market’s growth is expected to be hampered by the security vulnerability of transactions across the industry platform using blockchain technology. In contrast, a lack of understanding of blockchain technology is expected to provide lucrative opportunities for blockchain in the insurance market in the coming years.

Region Analysis:

North America is expected to dominate blockchain technology adoption in the insurance market. The financial sector, which includes banking, financial services, and insurance, is focusing on blockchain technology because of its numerous advantages. For example, all of North America’s major banks, including JPMorgan, the Royal Bank of Canada, and Bank of America, are investing in blockchain technology. Furthermore, a survey conducted by Accenture found that 9 out of 10 banks in North America are deploying blockchain technology for their payment applications, indicating the rapid growth of the blockchain technology.

Key Highlights:

- In 2022, Beazley, a specialist insurer, has announced the launch of a new Directors’ & Officers’ liability (D&O) insurance product designed specifically for cryptocurrency businesses.

- In 2022, Covinsure, according to Zetrix, will provide insurance using blockchain technology and cryptocurrency as a payout. Zetrix has simplified the process of getting insured by requiring only a passport and a Zetrix wallet.

Key Market Insights from the report:

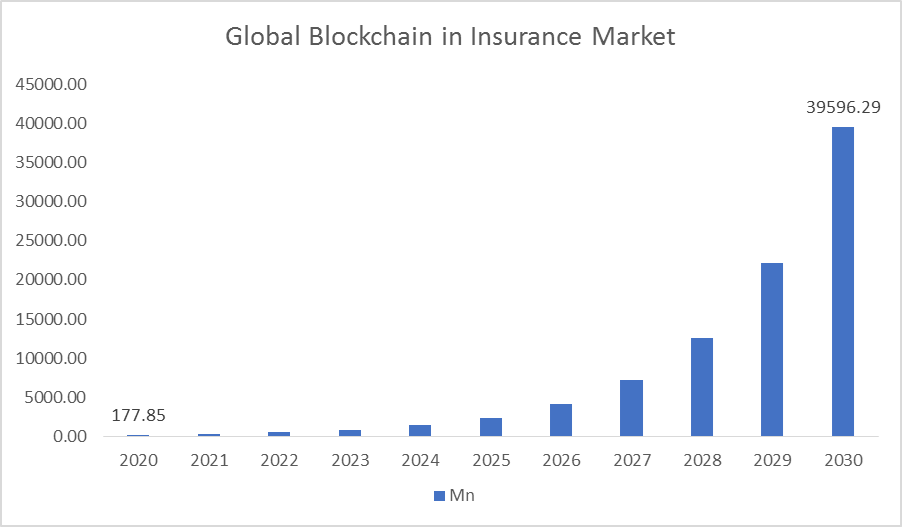

Global Blockchain in Insurance Market accounted for US$ 177.85 million in 2020 and is estimated to be US$ 39.56 billion by 2030 and is anticipated to register a CAGR of 72.4%. The global Blockchain in Insurance Market is segmented based on Sector Type, Enterprise Size, Provider, Deployment Model, Application and region.

- Based on Sector Type, Blockchain in Insurance Market is segmented into Health Insurance, Title Insurance and Life Insurance.

- Based on Enterprise Size, Blockchain in Insurance Market is segmented into Large Enterprise and Small & Medium Enterprise.

- Based on Provider, Blockchain in Insurance Market is segmented into Application & Service Provider, Infrastructure & Protocols Provider and Middleware Provider.

- Based on Deployment Model, Blockchain in Insurance Market is segmented into On-Premise and Cloud.

- Based on Application, Blockchain in Insurance Market is segmented into Smart Contracts, GRC Management, Death & Claims Management, Identity Management & Fraud Detection, Payments and Others.

- By Region, the Blockchain in Insurance Market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Competitive Landscape & their strategies of Blockchain in Insurance Market:

The key players operating in the Blockchain in Insurance Market includes Applied Blockchain (UK), Algorythmix (India), Auxesis Group (India), AWS (US), Bitfury (US), BitPay (US), BlockCypher (US), BTL Group (Canada) and Cambridge Blockchain (US).

Scope of the Report:

- Global Blockchain in Insurance Market, By Sector Type, 2020 – 2030, (US$ Mn)

- Overview

- Market Value and Forecast (US$ Mn), and Share Analysis (%), 2020 – 2030

- Y-o-Y Growth Analysis (%), 2020 – 2030

- Segment Trends

- Health Insurance

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Title Insurance

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Life Insurance

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Overview

- Global Blockchain in Insurance Market, By Enterprise Size , 2020 – 2030, (US$ Mn)

- Overview

- Market Value and Forecast (US$ Mn), and Share Analysis (%), 2020 – 2030

- Y-o-Y Growth Analysis (%), 2020 – 2030

- Segment Trends

- Large Enterprises

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Small & Medium Enterprises

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Overview

- Global Blockchain in Insurance Market, By Provider , 2020 – 2030, (US$ Mn)

- Overview

- Market Value and Forecast (US$ Mn), and Share Analysis (%), 2020 – 2030

- Y-o-Y Growth Analysis (%), 2020 – 2030

- Segment Trends

- Application & Service Provider

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Middleware Provider

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Infrastructure & Protocols Provider

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Overview

- Global Blockchain in Insurance Market, By Deployment Model, 2020 – 2030, (US$ Mn)

- Overview

- Market Value and Forecast (US$ Mn), and Share Analysis (%), 2020 – 2030

- Y-o-Y Growth Analysis (%), 2020 – 2030

- Segment Trends

- On-Premise

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Cloud

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Overview

- Global Blockchain in Insurance Market, By Application, 2020 – 2030, (US$ Mn)

- Overview

- Market Value and Forecast (US$ Mn), and Share Analysis (%), 2020 – 2030

- Y-o-Y Growth Analysis (%), 2020 – 2030

- Segment Trends

- Smart Contracts

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- GRC Management

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Death & Claim Management

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Identity Management & Fraud Detection

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Payments

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Others

- Overview

- Market Size and Forecast (US$ Mn), and Y-o-Y Growth (%), 2020 – 2030

- Overview

Some Important Points Answered in this Market Report Are Given Below:

- Explains an overview of the product portfolio, including product development, planning, and positioning

- Explains details about key operational strategies with a focus on R&D strategies, corporate structure, localization strategies, production capabilities, and financial performance of various companies.

- Detailed analysis of the market revenue over the forecasted period.

- Examining various outlooks of the market with the help of Porter’s five forces analysis, PEST & SWOT Analysis.

- Study on the segments that are anticipated to dominate the market.

- Study on the regional analysis that is expected to register the highest growth over the forecast period

Source: PMI