Bitcoin’s Rally Buoys Derivatives Market Amid Muted Leverage

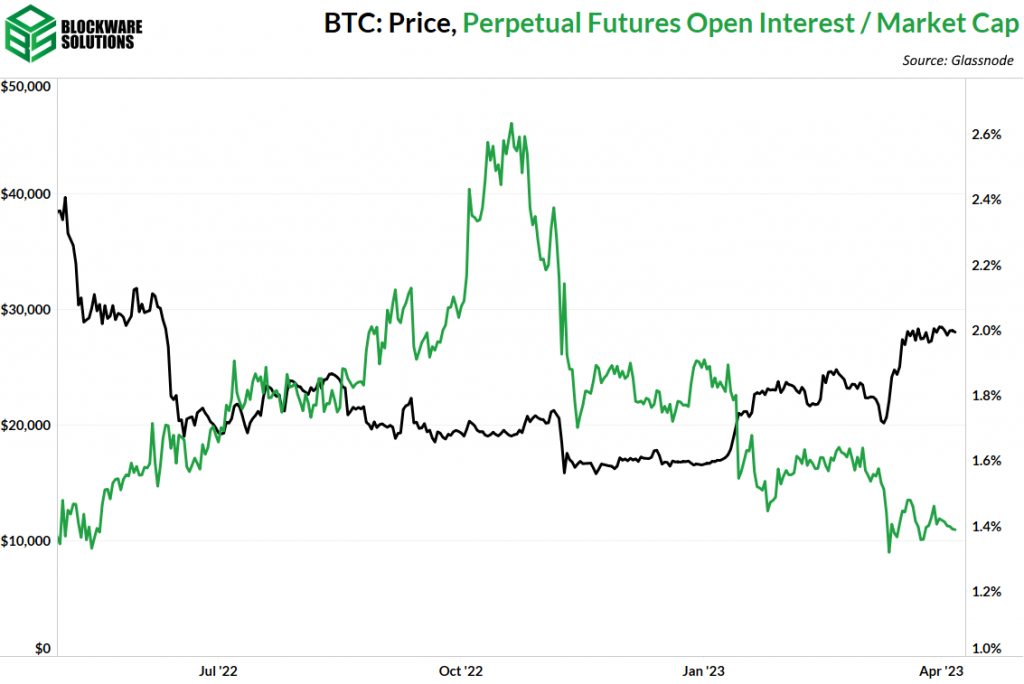

BTC sees 70% YoY surge to peak above $29k, breathing life back into derivatives market. However, Blockware Solutions analysts report low leveraging activity, indicating a reduced risk of liquidation-triggered price swings.

Falling Leveraging Ratio Cools Risk Appetite

As the ratio of perpetual futures open interest to market cap decreases since FTX’s November collapse, investors’ appetite for risk seems to have cooled. Non-expiring perpetual futures, which usually see more action during stagnant price activity, haven’t experienced significant open interest buildup despite Bitcoin’s steady sideways trading over the past three weeks.

BTC Maintains Steady Trading Range

Bitcoin has remained in a tight trading range between $29,000 and $27,000 since March 21. Despite the rally and a possible steady period ahead, Blockware Solutions’ analysts maintain their predictions of reduced volatility, citing a continued decrease in the open interest to market cap ratio.

Source: CoinDesk