Bitcoin and ether are trading higher ahead of U.S. inflation data and the Fed’s latest interest rate decision. Crypto stocks sank throughout the week.

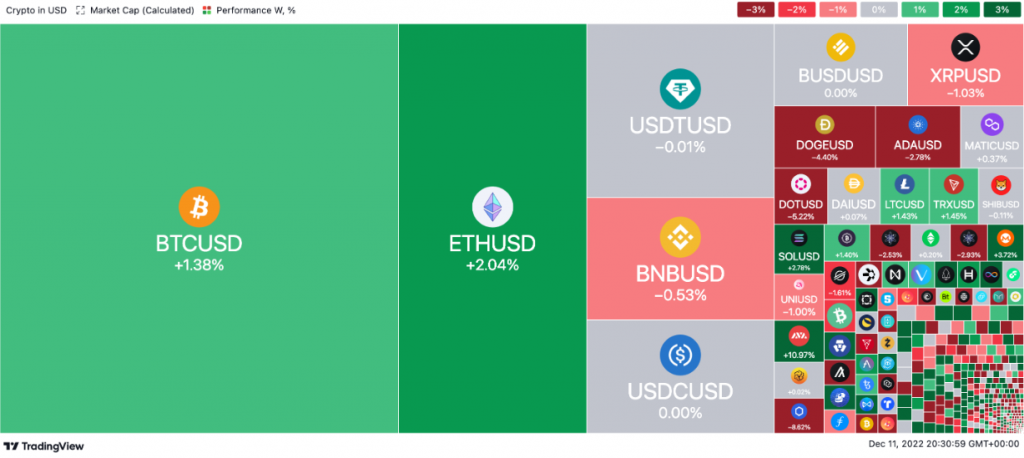

Bitcoin was changing hands at about $17,108 at 3:30 p.m. EST on Sunday, representing a rise of about 1.4% over the past week. Ether was doing somewhat better, up 2% in the same period. ETH was trading at roughly $1,265.

Crypto Heatmap chart by TradingView

Altcoins were less consistent, with several dropping over the week. Binance’s BNB slipped 0.5%, Ripple’s XRP fell 1% and dogecoin dipped 4.4%.

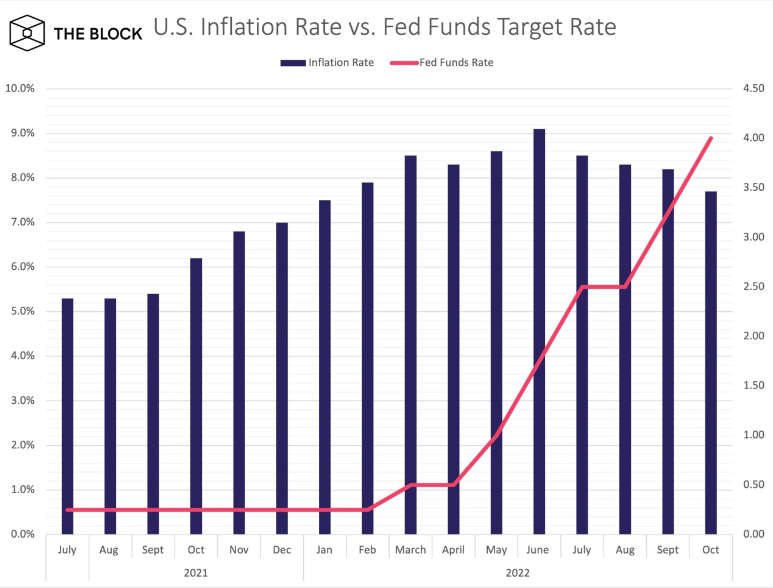

The Federal Open Market Committee (FOMC) is expected to announce an interest rate increase of 50 basis points on Wednesday. The increase would bring the Fed funds target rate range to between 4.25% to 4.5%. The CME’s group’s FedWatch tool — which analyzes Fed funds futures pricing data — sees a 78% probability of a 50 basis point increase.

source: federalreserve.org and bea.gov

The U.S. inflation data for November drops on Tuesday. October inflation came in below estimates at 7.7%.

Crypto stocks and structured products.

The Nasdaq dipped 2.8%, while the S&P 500 shed 2.9%.

Coinbase fell almost 17% over the week to trade at an all-time low of $40.24, according to Nasdaq data. Meanwhile, crypto bank Silvergate shed over 17% in the same period, trading around $21.43 at the close on Friday.

Jack Dorsey’s Block was down more than 4.1% to $64.60. Elsewhere, Michael Saylor’s MicroStrategy rose over 2.5% during the week to $203.25.

The discount on Grayscale’s GBTC to net asset value (NAV) continued to widen throughout the week. The discount reached 47.9% on Friday. The discount means shares in the fund trade at a discount of almost 48% versus the value of the bitcoin the fund holds.

Source: The Block