Bitcoin was treading water at around $23,000, while ether and altcoins traded higher. Equities were mixed, with Silvergate down and Coinbase higher.

Bitcoin was trading at $23,037 by 10:40 a.m. EST, up about 2.7% over the past 24 hours, according to TradingView data.

Ether rose 4.4% to around $1,604 by 10 a.m. EST. Cardano’s ADA was up 6.9%, and Polygon’s MATIC soared over 12% in the last 24 hours.

Aptos continued to benefit from the recent rally, trading up about 20%. APT reached a fresh all-time high of $19.92 earlier in the day.

Dog-themed memecoins bounced back after declining this week. Dogecoin and shiba inu were up 3.1% and 4.4%, respectively.

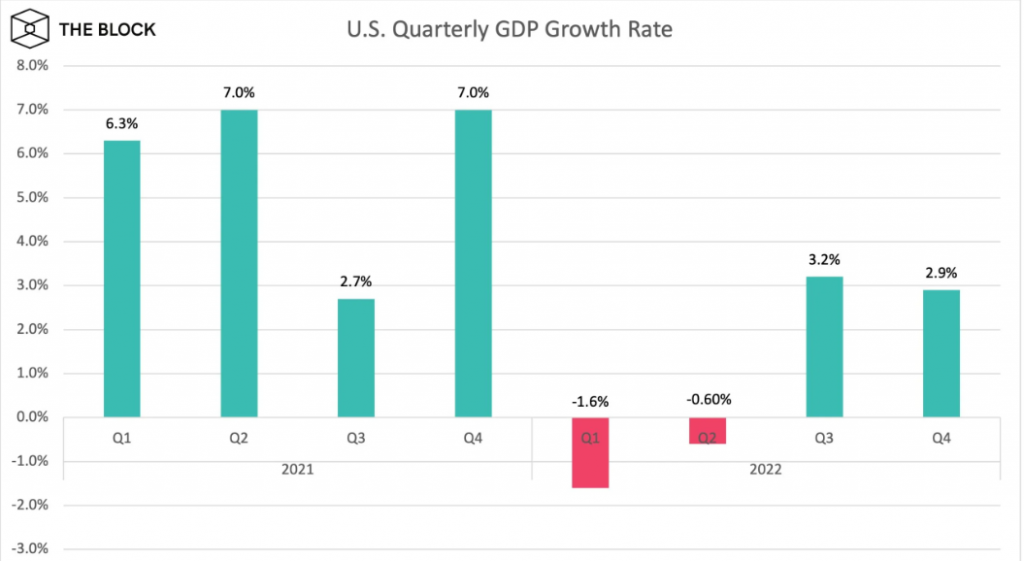

According to the advance estimate data from the U.S. Bureau of Economic Analysis, the U.S. economy grew by 2.9% between October and December, primarily driven by consumer and federal government spending.

Bitcoin’s price whipsawed following the news before recovering above $23,000.

Crypto stocks

Silvergate fell 2% to around $14 by 10:30 a.m., according to Nasdaq data, alongside Jack Dorsey’s Block, which also fell — shedding 0.6% to trade around $80.

MicroStrategy and Coinbase traded higher. Shares in the crypto exchange were up 2%, Michael Saylor’s MSTR added 0.2%.

Next Wednesday, the U.S. central bank is expected to increase interest rates by 25 basis points, which is likely to impact crypto-related stocks. The CME Group’s FedWatch tool shows a 99.8% likelihood of a 25 basis point increase, bringing the target rate to 4.50-4.75%.

Source: The Block