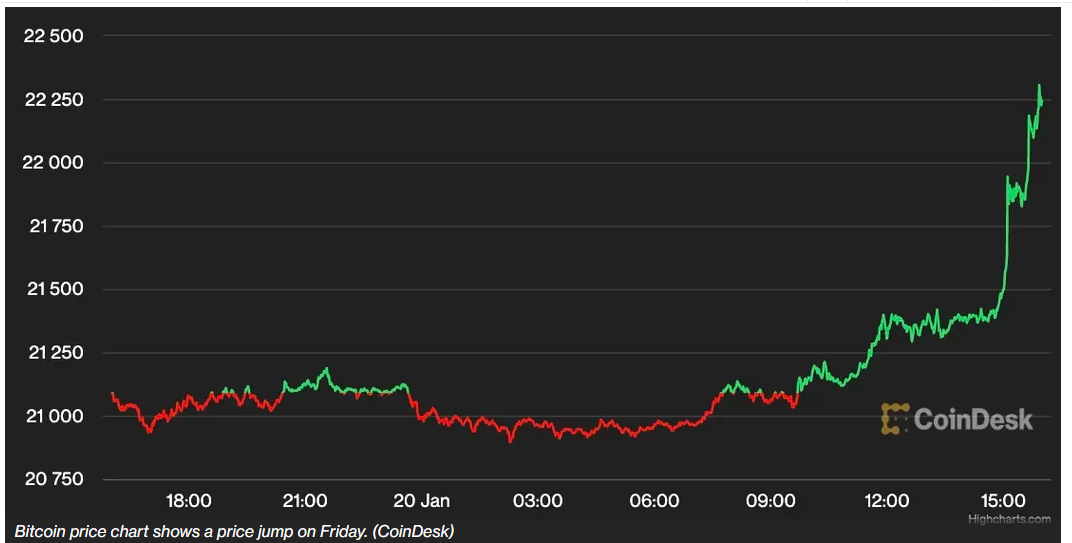

Bitcoin soared past $22,000, its highest level since mid-September, as the broader cryptocurrency market continued its unexpected 2023 rally.

The largest cryptocurrency by market capitalization was recently trading as high as $22,387, up 5.4% over the previous 24 hours, shrugging off the announcement late Thursday that Genesis Global Holdco LLC, the holding company of troubled cryptocurrency lender Genesis Global Capital, had filed for Chapter 11 bankruptcy protection late Thursday. (Genesis and CoinDesk are owned by Digital Currency Group.)

Edward Moya, senior market analyst for foreign exchange market maker Oanda, noted Thursday that investors had priced in Genesis’ looming problems. The company has been swept up in the fallout from the collapses of crypto hedge fund Three Arrows Capital last spring and, more recently, crypto exchange giant FTX.

Ether (ETH) followed a similar path, recently rising 5.2% from Thursday, same time, to $1,640. The CoinDesk Market Index (CMI) was up 4.1%.

BTC has climbed 11% in the past seven days and is up 34% for the year. ETH has jumped 12% over the past week and is up 37% since Dec. 31.

Crypto-related stocks also benefited from the rally Friday: Exchange Coinbase (COIN) was recently up 10% while bitcoin miner Marathon Digital Holdings (MARA) surged 9%.

Traditional markets also edged up, with the S&P 500 index up 1.9%, as investors processed a flurry of mixed earnings reports from big banks.

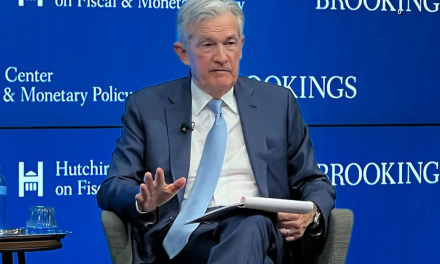

This week’s larger-than-expected decline in the producer price index (PPI) indicated the U.S. Federal Reserve’s monetary hawkishness has been taming inflation, buoying investors. The CME FedWatch tool currently shows that traders see roughly a 97% chance that the Federal Open Market Committee (FOMC) will raise rates by just 25 basis points (0.25 percentage point) at its next meeting in February – slowing from the 50 basis-point hikes in the December meeting.

Sheraz Ahmed, managing partner at STORM Partners, told CoinDesk that while recent macro data – “including a modest pullback in inflation, downwards-trending wage and employment data and a seemingly weaker dollar”– have induced some market relief, how the Fed will handle monetary policy while balancing economic data and recession fears will have a big impact on the market overall.

“Post-rally euphoria is always a great feeling but it should be treated with caution to avoid mistakes whether prices continue to rise or fall,” Ahmed said.

Oanda’s Moya said in a Friday note that if more tightening goes beyond the March meeting, “risky assets broadly, including crypto, could be vulnerable to major selling pressure.”

Source: CoinDesk