Bitcoin and Ether Surge in Eventful Week of Ethereum Shanghai Upgrade and Inflation Data

Confidence in crypto markets has rebounded as major digital assets including #Bitcoin and Ether rose about 9% and 11%, respectively, over the past seven days. The week also included the highly anticipated Ethereum Shanghai upgrade and promising inflation data.

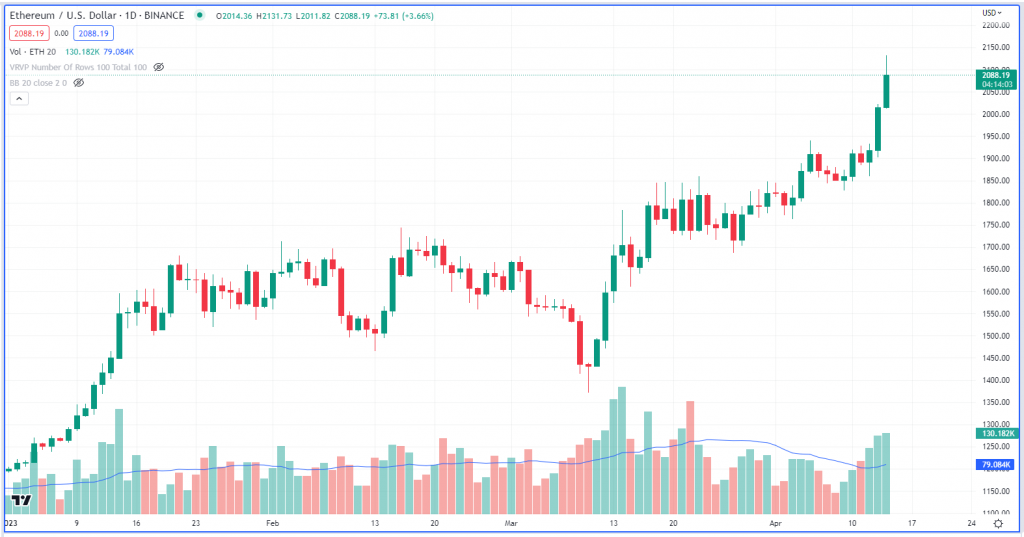

Ether’s Positive Response to Shanghai Upgrade

Following the successful completion of the Shanghai upgrade, allowing ETH stakers to withdraw their deposits, Ether has increased about 9% in price. The market initially feared the unlocking of 18.2 million ETH would lead to selling pressure, but markets have so far viewed the de-risking of ETH staking positively. As a result, ETH’s price upswing has led to the asset chipping away at bitcoin dominance by market capitalization.

Increased Trading Volume and Bullish Indicators

The surge in digital asset prices has also seen a rise in crypto market trading volume. Ether’s daily volume spiked to more than twice its 20-day moving average on Thursday, while BTC volume breached its 20-day moving average each day this week, with the exception of Thursday. Additionally, both BTC and ETH breached the upper range of their Bollinger Bands this week, indicating increased bullishness in the market.

Despite the positive developments, bond markets have begun to respond to the economic reports with the spread between two- and 10-year Treasury bonds, while still negative, narrowing since early March. The Federal Reserve will meet again in May to discuss the potential of raising interest rates, with the recent inflation data and jobless claims providing some justification for holding off. Nonetheless, crypto markets have seen a boost in confidence as investors turn their attention to the ongoing developments in digital assets.

Source: CoinDesk