Venture Capitalists Warn Crypto Startups to Beware of “Dry Powder Fallacy”

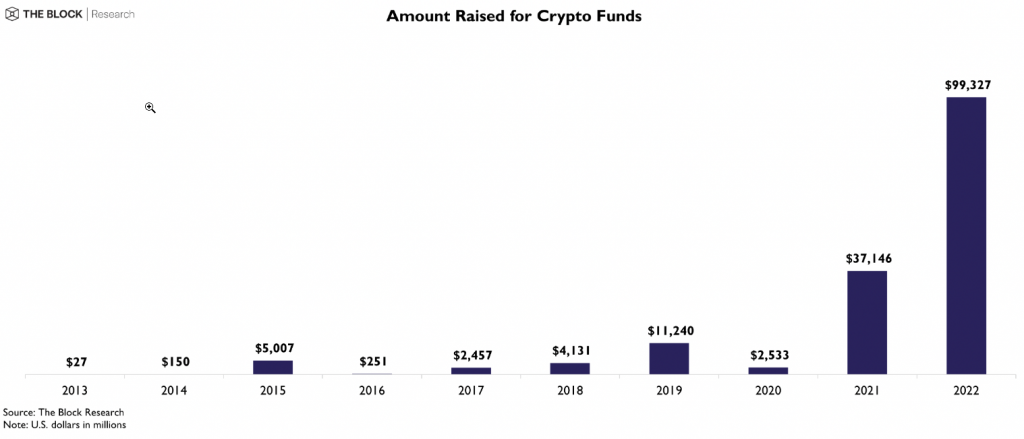

Venture capitalists caution crypto founders against assuming that the availability of uninvested cash or “dry powder” can weather bear markets. Last year, investors raised $99.3 billion for crypto funds, bringing the total raised to $162.2 billion. While it is unclear how much is uninvested due to undisclosed deals, Edvinas Rupkus of The Block Research estimates it to be in the tens of billions. However, venture capitalists warn that this should be viewed as a directional measure of investor appetite for the industry rather than an absolute.

Abundance of Dry Powder, but There’s a Catch

Sequoia, A16z, Haun Ventures, BlockTower, and Dao5 have deployed less than half of their respective funds despite being in operation for a year or more. However, this abundance of dry powder can be misleading because capital gets called in tranches, which makes it unavailable to deploy on day one. Some VCs might return their dry powder to LPs and exit, further reducing the overall reserves. If the dry powder isn’t being deployed, it could be a warning sign that the VC is not optimistic about valuations or industry prospects.

A Cause for Celebration or a Warning Sign?

The dry powder fallacy assumes a certain pacing and that it can be replenished. But with the deployment pacing being too hot, too cold, or just right, the accumulation of dry powder can be misinterpreted as a sign of success or failure. If a VC firm, having promised limited partners a slower deployment schedule, burned through its capital in the bull market, it could be in a pinch to raise again in the era of high-interest rates and regulatory scrutiny. Investors should be cautious in interpreting the amount of dry powder as a true measure of the industry’s health.

Source: The Block