ASML, a pivotal player in the artificial intelligence (AI) investment landscape, recently announced exciting news that has the investment community buzzing. Known for its unique position as a critical supplier across the AI value chain, ASML has unveiled its next-generation high-NA extreme ultraviolet (EUV) lithography machines. This development is not just a testament to ASML’s continuous innovation but also a significant leap forward in chip manufacturing technology, reinforcing ASML’s indispensable role in the AI revolution.

ASML’s lithography machines are at the heart of modern microchip production, enabling the creation of the most advanced, energy-efficient chips down to 3 nanometers. With the introduction of these new high-NA EUV machines, ASML cements its status as the sole provider of such advanced technology, effectively holding a technological monopoly—a rarity in the fiercely competitive tech industry. This innovation ensures that ASML remains a step ahead of potential competitors, providing semiconductor giants like Taiwan Semiconductor and Intel with the tools needed to produce the next generation of microchips.

The significance of these machines for AI cannot be overstated. The demand for powerful, efficient chips is escalating as AI technologies advance, requiring more sophisticated data processing capabilities. ASML’s machines are crucial for developing chips that meet these demands, directly linking ASML’s success with the growth of the AI sector.

Despite the excitement around its technological advancements, ASML’s financials present a nuanced picture. The company’s cutting-edge EUV machines come with a hefty price tag, contributing to fluctuations in ASML’s quarterly results. However, the high cost of these machines is balanced by their significant impact on ASML’s revenues, demonstrated by the company’s impressive sales figures in recent quarters.

Looking ahead, ASML anticipates 2024 to be a transitional year, with expectations of sustained sales levels compared to 2023, ahead of a predicted strong growth phase in 2025. This forecast suggests a period of consolidation and preparation for the next wave of demand in the AI and semiconductor markets.

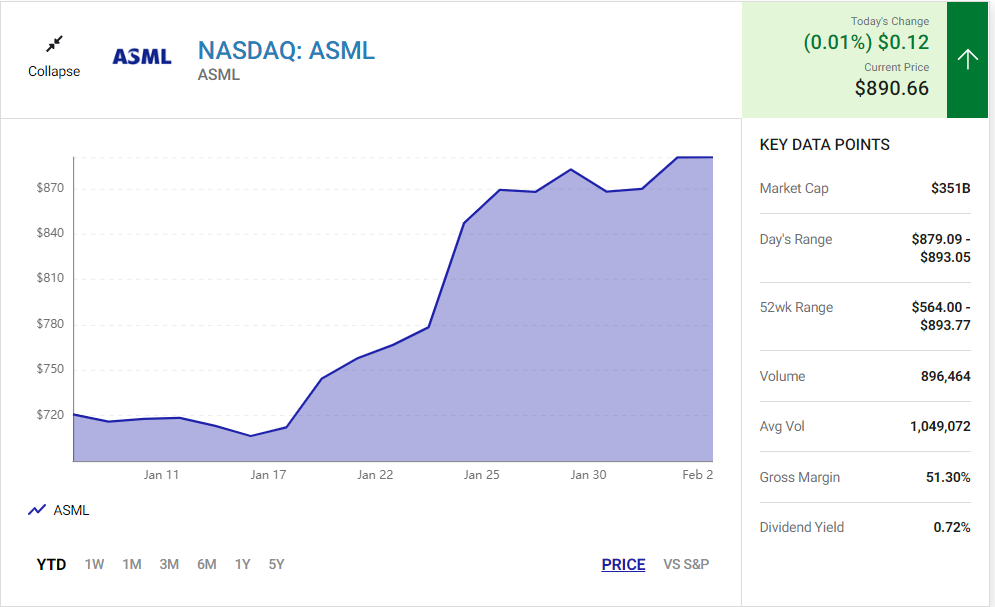

Investors in ASML are advised to exercise patience. Despite the stock’s current high valuation, trading at around 41 times earnings, ASML’s track record of delivering at high valuation levels may justify investor confidence. However, prospective buyers are cautioned against overpaying in the short term, with the suggestion to wait for a more favorable market valuation to invest in ASML. This strategy acknowledges the potential for market fluctuations to present better buying opportunities, albeit at the risk of missing out on immediate gains from ASML’s pivotal role in the AI industry’s growth.