The Silent Revolution in Enterprise Blockchain

When the Cardano Foundation unveiled its ecosystem guide on January 23, detailing how 582 projects are reshaping global industries, it wasn’t just another blockchain report. This 54-page document, dissecting initiatives across traceability, authenticity, and sustainability, signals a tectonic shift in how enterprises perceive decentralized technology. Forget speculative crypto trading—this is blockchain’s quiet revolution, where supply chains, healthcare records, and carbon credits are being rebuilt on Cardano’s proof-of-stake architecture.

“These numbers prove blockchain is graduating from theoretical promise to operational necessity,” says Frederik Gregaard, CEO of the Cardano Foundation, in an exclusive interview. “We’re seeing Fortune 500 companies quietly piloting solutions that could redefine how global commerce operates.”

Cardano’s Calculated Ascent

To understand why this report matters, one must first grasp Cardano’s unique positioning. Launched in 2017 as a “third-generation” blockchain, Cardano differentiated itself through peer-reviewed research, a layered architecture (separating settlement and computation), and Ouroboros, its energy-efficient proof-of-stake protocol. While rivals like Ethereum grappled with gas fees and scalability, Cardano methodically built infrastructure for enterprise-grade applications.

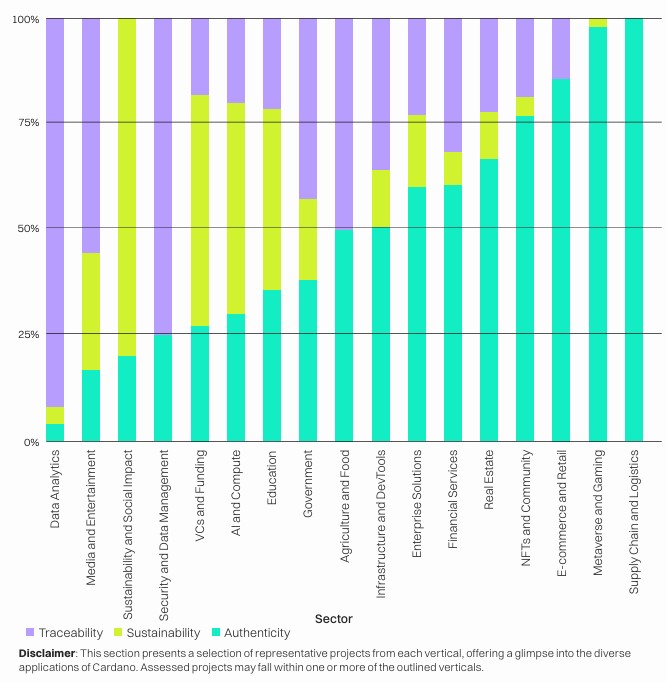

Percentage of projects by sector and vertical. Source: Cardano Foundation

The Foundation’s latest research categorizes projects into three verticals:

- Traceability (30%): Immutable tracking of physical/digital assets (e.g., coffee bean supply chains).

- Authenticity (54.6%): Secure verification of identities and credentials (e.g., tamper-proof academic degrees).

- Sustainability (15.4%): Tools for environmental/social impact (e.g., carbon credit marketplaces).

“These pillars address pain points traditional systems can’t,” explains Gregaard. “Legacy supply chain software might track shipments, but can’t cryptographically prove a diamond’s conflict-free origin. That’s where blockchain becomes indispensable.”

Inside Cardano’s Enterprise Machine

Case Study 1: BeefChain’s Traceability Triumph

One standout project is BeefChain, a Wyoming-based startup using Cardano to track cattle from ranch to retail. By embedding IoT sensors and blockchain records, retailers like Whole Foods can instantly verify claims like “grass-fed” or “hormone-free.”

“With Cardano, we reduced audit costs by 70%,” says BeefChain CTO Mark Rasmussen. “Retailers used to spend weeks manually verifying paperwork. Now, it’s real-time.”

Case Study 2: Atala PRISM’s Identity Revolution

Cardano’s Atala PRISM, a decentralized identity solution, is being piloted by Ethiopia’s Ministry of Education to issue blockchain-verified diplomas. This prevents credential fraud—a $1 billion global problem.

The Regulatory Angle

“Traceability isn’t optional anymore,” notes Dr. Linda Peters, a EU regulatory advisor. “With laws like the Digital Product Passport requiring supply chain transparency, Cardano’s tamper-proof logs are becoming compliance tools.”

How Cardano Makes It Work

Cardano’s edge lies in its tailored infrastructure:

- Plutus Smart Contracts: Unlike Ethereum’s Solidity, Plutus uses Haskell, a language favored for high-assurance systems (e.g., aerospace), reducing coding errors.

- Hydra Scaling Solution: Layer-2 protocol enabling ~1 million transactions per second, critical for global supply chains.

- Mithril Protocol: Enhances node synchronization speed by 90%, crucial for enterprises needing real-time data.

“Enterprises can’t afford downtime,” says Matthias Benkort, Cardano’s Technical Lead. “Our rigorous peer-review process ensures upgrades don’t break existing applications—a key advantage over chains that move fast and break things.”

The Enterprise Blockchain Race Heats Up

Cardano’s 70% international project rate positions it as a global contender, but competition is fierce:

- VeChain: Dominates luxury goods traceability via partnerships with LVMH.

- Hyperledger: IBM-backed, popular in finance.

- Ethereum: Still leads in DeFi but faces scalability hurdles.

However, Cardano’s sustainability focus aligns with ESG investing trends. “Corporations face investor pressure to decarbonize,” says Gartner analyst Avivah Litan. “Blockchain solutions that prove ESG compliance will capture a $30 billion market by 2025.”

Walking the Tightrope

While Cardano’s PoS consumes 99% less energy than Bitcoin, critics argue blockchain isn’t a silver bullet. “Sustainability requires systemic change, not just tech fixes,” cautions Greenpeace’s Rolf Skar.

Regulatory challenges persist, too. The EU’s MiCA framework demands strict AML checks—a hurdle for anonymity-focused chains but a boon for Cardano’s KYC-friendly design.

Beyond the Hype Cycle

Gregaard envisions Cardano becoming the “Linux of enterprise blockchain”—a neutral, open-source foundation for industries. Upcoming upgrades like Chang Hard Fork (decentralized governance) could accelerate adoption.

“In five years, checking a product’s blockchain record will be as routine as reading a nutrition label,” predicts MIT’s Dr. Silvio Micali.

The Quiet Disruption

The Cardano Foundation’s report isn’t just a snapshot—it’s a roadmap for blockchain’s second act. As enterprises pivot from pilots to production, Cardano’s blend of academic rigor, regulatory alignment, and real-world utility positions it at the vanguard of a transformation far more consequential than crypto’s speculative waves. The question isn’t whether blockchain will reshape industries, but which chain they’ll choose to build on.