History indicates the Nasdaq might surge in 2024, making one AI Stock to Buy

Amazon is discreetly advancing in artificial intelligence (AI), potentially significantly benefiting its primary operations, an AI Stock to Buy. AI is currently a highly sought-after sector in the stock market, with last year’s enthusiasm for the technology propelling the Nasdaq Composite to a more than 40% increase. Additionally, large tech corporations, including the “Magnificent Seven,” have significantly contributed to the S&P 500 reaching new highs.

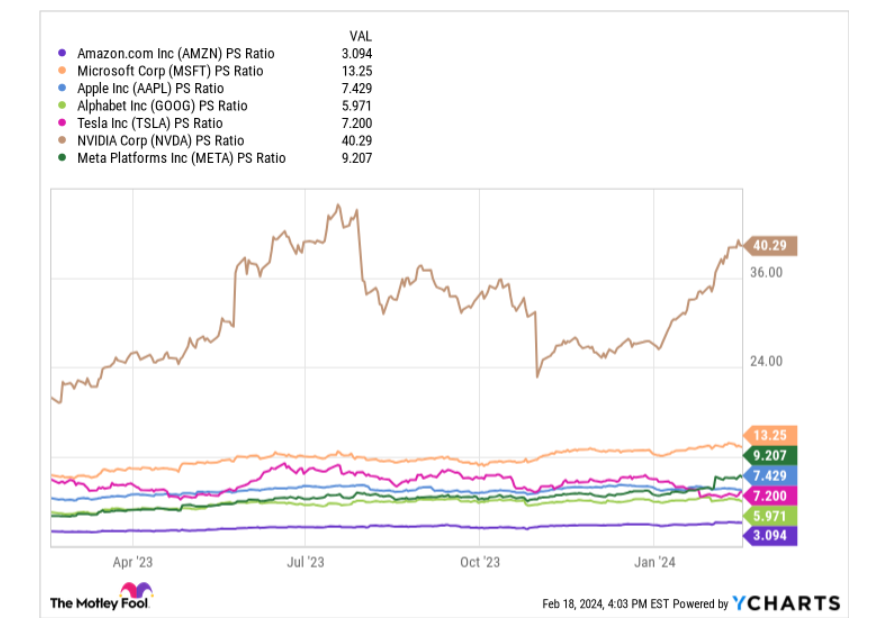

Microsoft and Nvidia are often highlighted in the media among the Magnificent Seven, with good reason. Microsoft has invested heavily in OpenAI, the creator of ChatGPT, while Nvidia experiences unparalleled demand for its GPUs due to their use in quantum computing and machine learning.

Amazon, an expert in e-commerce and cloud computing, appears to be underrated despite its intriguing AI investments. However, the slowdown in its cloud division’s growth and economic challenges have led some investors to question its future.

Exploring Amazon’s potential in 2024 and its AI strategy reveals why it stands out among its competitors.

The Nasdaq has a history of resilience

Having existed for over five decades, the Nasdaq Composite index has seen negative annual returns only 14 times. In the past twenty years, it has only dropped by 30% or more thrice: in 2002, 2008, and 2022, with 2008 marking the onset of the Great Recession and 2022 being challenging due to high inflation. However, the Federal Reserve’s quick interest rate adjustments aimed at inflation control show the market’s resilience. Post-decline, the Nasdaq historically rebounds strongly, suggesting potential robust performance in 2024, especially with growing AI interest.

Amazon’s AI investments warrant attention

Amazon’s recent multi-billion-dollar investment in Anthropic, an OpenAI rival, aims to enhance its cloud services. With businesses tightening budgets recently, tech sectors, including Amazon’s cloud service, faced reduced demand. Yet, Amazon’s cloud operations are crucial, comprising nearly 70% of its operating profits. The Anthropic deal, which involves using Amazon Web Services (AWS) for cloud provisioning and Amazon’s semiconductors for AI model training, could boost AWS demand through new AI-powered cloud applications.

Comparing Amazon with the Magnificent Seven on a price-to-sales basis, Amazon appears undervalued, suggesting it may be underestimated in AI or not demonstrating enough growth for a higher valuation. However, Amazon’s steps towards leveraging AI in its e-commerce and cloud segments indicate its strong growth potential.

Despite being overshadowed by other tech giants, Amazon’s AI prospects are promising. The current valuation presents a unique opportunity for long-term investors to acquire shares at an attractive price.