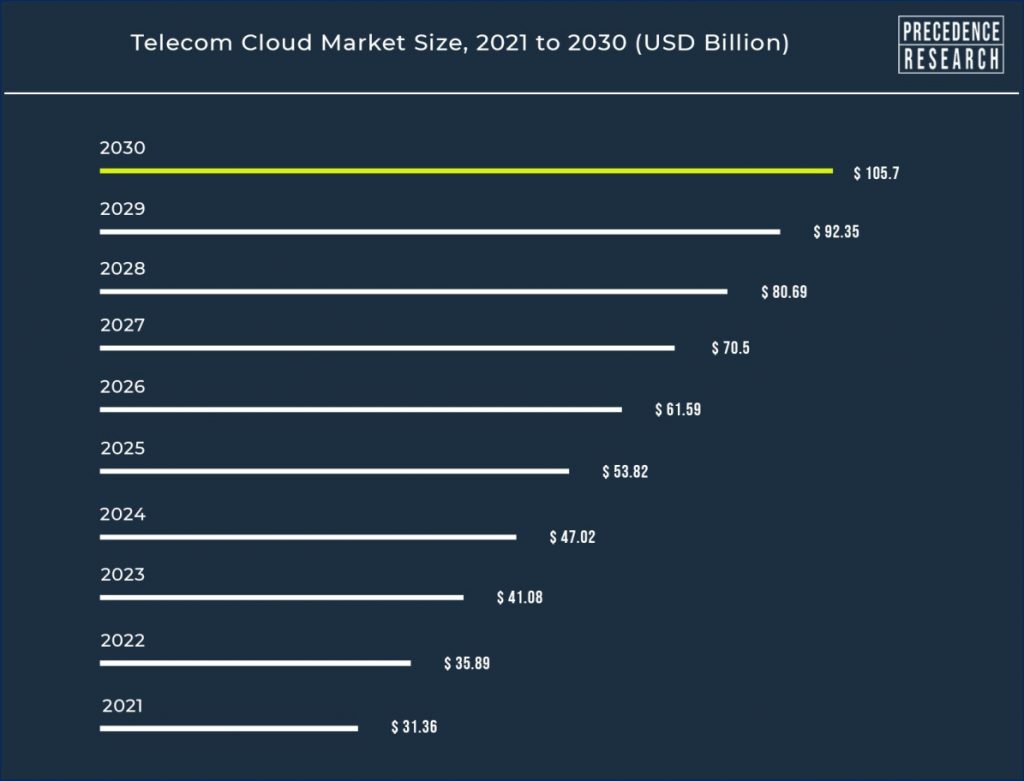

London – The global telecom cloud market size was valued at US$ 31.36 billion in 2021. Current research and development endeavors are expected to raise revenue in the global telecom cloud market. Market participants fund the majority of these initiatives in the telecom cloud market, strategic relationships are extremely important. These steps are taken by market players in order to strengthen their positions, resulting in an increase in the growth rate of the telecom cloud market.

Significant changes in global firm operations have emerged from improvements in communications and information technology. A wide range of government and public sector organizations rely on the critical information infrastructure services. In addition, businesses are becoming more interested in cloud services in order to meet increased demand from corporate operations.

Regional Snapshot

Asia-Pacific is the largest segment for telecom cloud market in terms of region. China and Indiaare dominating the telecom cloud market in the Asia-Pacific region. The acceptance of new and advanced technologies and the rapid deployment of 5G networks are driving the telecom cloud market in the Asia-Pacific region. The latest technologies like the cloud computing, internet of things, blockchain, and artificial intelligence have been adopted by key market players.

North America region is the fastest growing region in the telecom cloud market. The U.S. hold the highest market share in the North Americatelecom cloud market. the businesses in North America are quickly accepting and adopting telecom cloud services in order to improve communication. The employees of these organizations are well versed in technical terms and motivated to increase the use of telecom cloud services, helping North America to dominate the telecom cloud market. Furthermore, the rise of the North American telecom cloud market is being fueled by rising funding and expenditures in data centers.

Scope of the Report

| Report Attributes | Details |

| Market Size in 2021 | USD 31.36 Billion |

| Revenue Forecast by 2030 | USD 105.7 Billion |

| Base Year | 2021 |

| Forecast Data | 2022 to 2030 |

| Companies Covered | Acorn Dairy Ltd., Amazon.com Inc., Andechser Molkerei Scheitz GmbH, Arla Foods amba, Aurora Organic Dairy, Barambah Organics Pty Ltd., China Shengmu Organic Milk Ltd., Danone SA, General Mills Inc., Organic Valley |

Report Highlights

- On the basis of type, services segment holds the largest market share in the global telecom cloud market. The network accounted for a significant portion of the services market in the telecom cloud industry. Because of the migration to cloud services, telecom operators can repurpose underused networking resources and profit from existing corporate ties.

- On the basis of computing service, IaaS segment holds the largest market share in the global telecom cloud market. The IaaS is a highly standardized and automated product that allows customers to access a service provider’s computer resources as well as storage capabilities on demand.

- On the basis of application, BFSI segment holds the largest market share in the global telecom cloud market. The non-core tasks are being outsourced by the BFSI sector to save costs and improve efficiency. As a result, focused content views and exact banking information are needed, which can be combined via a telecom cloud service.

Market Dynamics

Drivers

Surge in demand for open radio access network (RAN) and private 5G network

The open radio access network (RAN) allows different suppliers’ parts to communicate with each other. The usage of open radio access network (RAN) can help companies avoid becoming reliant on a single supplier’s software and hardware. In today’s world, the demand for a private 5G network is steadily expanding. As a result, surge in demand for open radio access network (RAN) and private 5G network is driving the growth of global telecom cloud market.

Restraints

Uncertainty of data loss

When consumers don’t have data preserved in their private systems, the risk of information loss is always prevailing. When data is accidentally erased by the user, expecting it will be kept somewhere else, or when the system becomes corrupted, there is risk of information loss. Thus, uncertainty of data loss is hindering the growth of global telecom cloud market.

Opportunities

Growing adoption of innovative technologies

Thecloud technologies are being accepted by firms in order to gain competitive edge and distinguish themselves in the global market. In the future years, expenditure on business intelligence and cloud infrastructure is likely to rise. The organizations have entered the cloud environment and actuated the telecom cloud industry as the number of cloud technologies utilized and cost reductions have increased. Thus, this factor is creating prospects for expansion of worldwide telecom cloud market.

Challenges

Concerns regarding interoperability and portability

Although the cloud is a new technology, mobility is major concern that must be addressed before using telecom cloud. Each cloud provider offers a unique collection of services and products. It becomes simple to migrate the cloud to multiple suppliers when it is simple to do so. As a result, this factor is the biggest challenge for telecom cloud market.

Recent Developments

- Cisco declared the acquisition of IMImobile, a cloud communications software and service firm, in December 2020, allowing Cisco to offer its consumers an end-to-end customer engagement management solution.

- Momentum Telecom, worldwide supplier of managed network and cloud voice, declared in April 2021 that it had completed its acquisition of Atlus Technology, a leading developer of cloud based unified communications systems in Tennessee.

Market Segmentation

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Type

- Solutions

- Unified Communication and Collaboration

- Content Delivery Network

- Other Solutions

- Services

- Colocation Services

- Network Services

- Management Service

- Content Management

- Supply Chain Management

- Business Support system(BSS)

By Computing Service

- IaaS

- PaaS

- SaaS

By Organization Size

- SMEs

- Large Enterprise

By Application

- Data Storage

- Achieving

- Computing

- Enterprise Application

- Cloud Delievery Model

- Communication and Collaboration

- Network Cloud Migration

- Over-The-Top

- Other Applications

End User

- BFSI

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Media and Entertainment

- Government

- Automotive

- Energy and Utilities

- Other End Users

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Source: Precedence Research