Lam Research: A Sleeper Hit in the AI Chip Stock Market with a 75% Yearly Surge and Potential for More

Investors scouting for opportunities within the burgeoning AI chip stock market might overlook Lam Research (NASDAQ: LRCX), yet this semiconductor firm is poised to thrive amidst the surging demand for AI technologies.

Despite its remarkable 75% surge over the past year, Lam Research’s journey has been under the radar, especially after it disclosed its fiscal 2024 Q2 earnings for the period ending December 24, 2023, on January 24, sparking further interest among investors.

This interest stems from the anticipation of a rebound in semiconductor equipment expenditure, which is crucial for Lam Research’s growth trajectory.

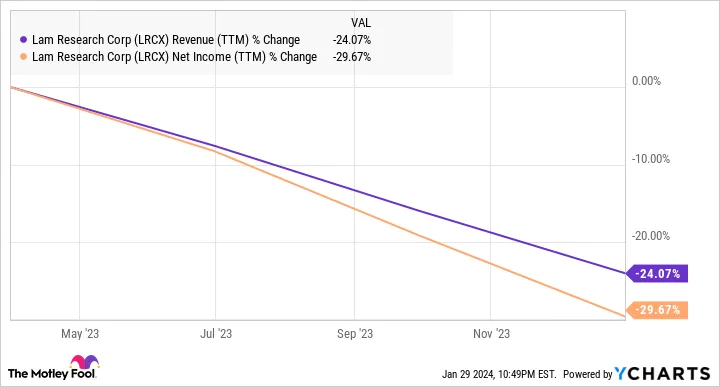

LRCX Revenue (TTM) Chart

The Path to Recovery in Semiconductor Equipment Spending

Lam Research reported a fiscal Q2 revenue of $3.76 billion, a 29% decrease from the previous year, alongside a reduction in non-GAAP earnings to $7.52 per share, down from $10.71. This downturn was largely due to a 2023 slump in semiconductor equipment spending, particularly affecting the memory chip segment.

With 48% of its revenue from memory equipment, the substantial 46% drop in this sector significantly impacted Lam Research. However, the company’s recent guidance suggests an impending financial rebound. For the current quarter ending March 31, Lam Research forecasts revenues around $3.7 billion and adjusted earnings of $7.25 per share, indicating a minor revenue decline and an earnings improvement year-over-year.

Analysts predict a nearly 16% revenue decline to $14.7 billion for the full year 2024, with earnings expected to fall to $27.93 per share. Despite this, projections for fiscal year beginning September 2024 show promising growth, driven by a 15% increase in semiconductor equipment spending to $97 billion in 2024, with the memory equipment sector expected to witness a remarkable 65% growth.

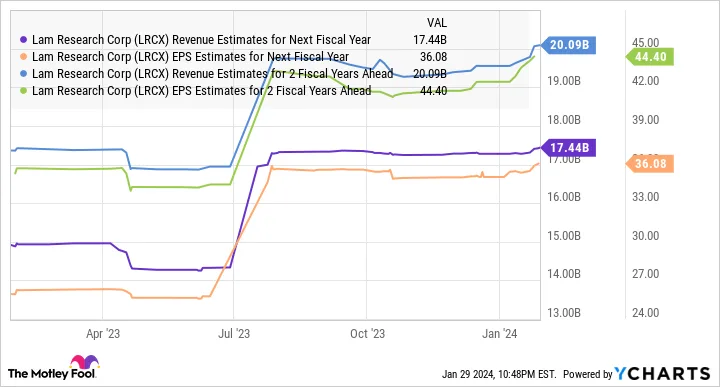

LRCX Revenue Estimates for Next Fiscal Year Chart

AI Adoption: A Catalyst for Growth

Lam Research is strategically positioning itself to benefit from the AI-driven demand for high-bandwidth memory (HBM), essential for AI servers. With HBM demand projected to increase significantly, driven by AI chipmakers like Nvidia (NASDAQ: NVDA) integrating more HBM into their processors, Lam Research stands to gain from this trend.

Nvidia’s advancements in HBM technology, including its GH200 Grace Hopper Superchip and the upcoming H200 AI processor, underscore the growing need for more HBM. This demand is supported by significant investments from Nvidia to secure HBM supply from manufacturers like SK Hynix and Micron Technology (NASDAQ: MU).

Micron’s focus on ramping up production of its latest HBM chips and its anticipation of growing HBM demand into 2025 further highlight the expanding market for memory technologies, benefiting companies like Lam Research.

Furthermore, the broader adoption of AI across smartphones and PCs, necessitating additional DRAM per device, suggests a rebound in memory demand and supply dynamics, aligning well with Lam Research’s core business.

Looking Ahead: Potential for Significant Growth

With analysts expecting Lam Research to achieve substantial revenue and earnings growth in the coming years, the company’s stock could see a 50% increase from current levels if it meets fiscal 2026 earnings projections of $44 per share while maintaining its forward earnings multiple.

This analysis suggests that Lam Research, buoyed by the AI chip boom and an improving memory market, represents a compelling investment opportunity with its stock rally poised to continue.

In summary, as the semiconductor industry gears up for a turnaround, Lam Research emerges as a key player to watch, with its strategic positioning in the AI chip market promising significant returns for forward-looking investors.