El Salvador has experienced a remarkable surge in its bonds due in 2027, which have gained an impressive 62% in the last six months, signaling the country’s improved financial standing.

The market often cites the lagging nature of traditional agencies’ ratings, and El Salvador’s recent experience with its Bitcoin holdings supports this notion. Following Fitch’s debt rating downgrade for El Salvador in September 2022, with a prediction of a debt default in January 2023, the country’s junk-rated bonds have seen a meteoric rise, closely mirroring Bitcoin’s astonishing rally throughout 2023.

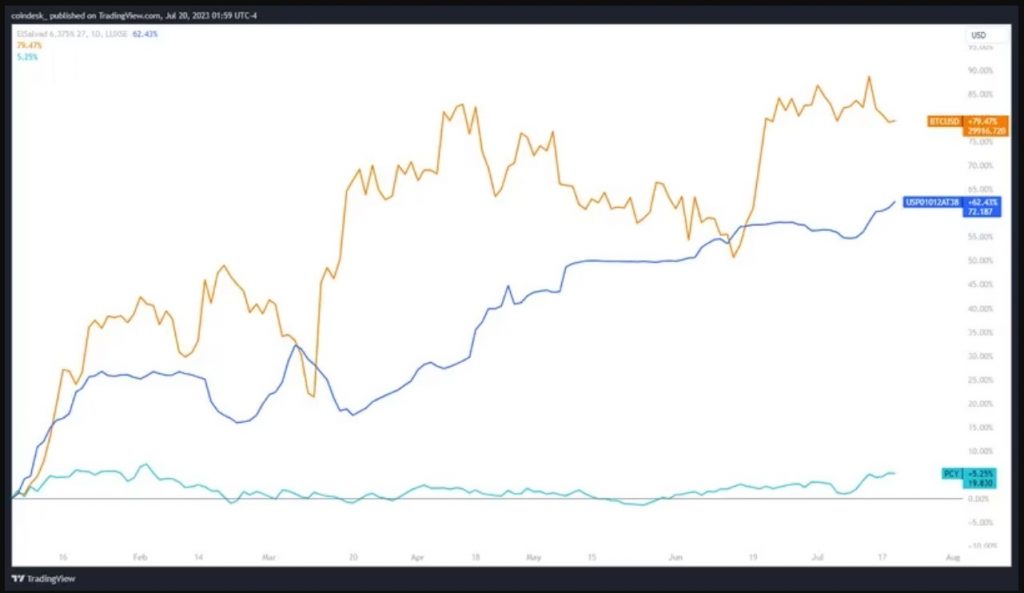

Market data reveals that the value of El Salvador’s bonds has surged by 62%, now trading at 72 cents on the dollar. During the same period, Bitcoin’s value has risen by an impressive 79%.

Remarkably, El Salvador’s bonds have even outperformed the Invesco Emerging Markets Sovereign Debt ETF (PCY), one of the largest holders of the country’s debt, as reported by Factset.

BTC vs El Salvador bond (TradingView) Image via Coindesk

In a surprising turn of events, in January, El Salvador announced that it had repaid an $800 million bond, despite Moody’s prediction that it would be unable to do so.

It’s essential to note that El Salvador embraced Bitcoin as legal tender in mid-2021 and began accumulating the cryptocurrency from September 2021. As of April, the country holds 2546 Bitcoins, calculated to be initially purchased for $108.2 million and now valued at $76.6 million based on current market data.

Additionally, Volcano Energy’s recent announcement of $1 billion in commitments to build a 241 megawatt (MW) Bitcoin mine in the Metapán region of El Salvador has further added to the country’s growing presence in the cryptocurrency space. Notably, investors in this venture include Tether, the issuer of USDT.

However, this move to diversify into Bitcoin has faced consistent disapproval from ratings agencies and the International Monetary Fund (IMF). Moody’s, in particular, has expressed concerns about El Salvador’s embrace of Bitcoin and its potential impact on the country’s debt maturity.

S&P also voiced skepticism in 2021, highlighting the “immediate, negative implications” of adopting Bitcoin as legal tender and raising credit risks.

Nonetheless, the IMF stated in February that the risks related to El Salvador’s adoption of Bitcoin have not materialized significantly due to the limited use of the cryptocurrency thus far. Despite this, the IMF urged caution and recommended that the authorities reconsider their plans to expand government exposures to Bitcoin, citing legal risks, fiscal fragility, and the speculative nature of crypto markets.

Interestingly, the recent change of fortune for Salvador’s bonds seems to be part of a broader market trend. Junk-rated bonds of Turkey, Argentina, and Nigeria have also outperformed investment-grade bonds early this year, indicating potential shifts in investors’ preferences and risk appetite.

Source: CoinDesk