Bitcoin, the world’s leading cryptocurrency, continues to captivate investors and enthusiasts worldwide. Despite concerns surrounding inflation and market volatility, Bitcoin has managed to maintain its value, hovering over $303,000. In this article, we delve into the current state of the cryptocurrency market, analyze the factors influencing Bitcoin’s price, and provide insights into the future prospects of this digital asset.

Understanding Bitcoin’s Resilience

The Bitcoin Market in Context

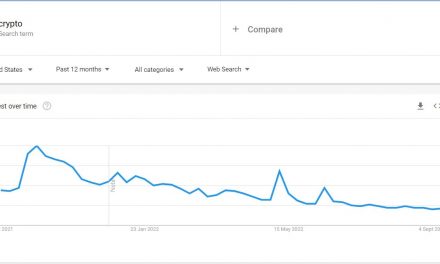

The cryptocurrency market is known for its inherent volatility, with prices experiencing rapid fluctuations. However, despite recent concerns about inflation, Bitcoin has demonstrated remarkable resilience, showcasing its status as a store of value and a hedge against traditional financial uncertainties.

Factors Supporting Bitcoin’s Stability

Several factors contribute to Bitcoin’s ability to maintain its value amidst inflation worries:

- Limited Supply: Bitcoin operates on a fixed supply schedule, with a maximum cap of 21 million coins. This scarcity drives demand and helps protect against the erosion of value caused by inflation.

- Decentralization and Trust: Bitcoin’s decentralized nature and the underlying blockchain technology provide transparency, security, and trust. These attributes contribute to its attractiveness as a viable alternative to traditional financial systems.

- Global Adoption: Bitcoin’s increasing acceptance as a payment method and investment asset by individuals, institutions, and even governments worldwide enhances its stability and fosters market confidence.

Exploring the Cryptocurrency Market Landscape

Altcoins and Market Diversity

While Bitcoin remains the dominant force in the cryptocurrency market, altcoins, or alternative cryptocurrencies, have gained significant traction. Ethereum, Binance Coin, and Cardano are just a few examples of altcoins that have garnered attention due to their unique features and potential use cases.

The Role of Regulation

As the cryptocurrency market matures, regulatory frameworks are being established to address concerns regarding security, fraud, and investor protection. Striking a balance between regulation and innovation is crucial to ensure the long-term sustainability and growth of the market.

Institutional Adoption and Market Confidence

The involvement of institutional investors, such as hedge funds, asset managers, and major corporations, has bolstered market confidence in cryptocurrencies. Increased institutional adoption brings credibility, liquidity, and stability to the market, driving further growth and interest.

Bitcoin’s Future Prospects

Evolving Financial Infrastructure

The continued development of cryptocurrency infrastructure, including improved scalability, transaction speeds, and user-friendly interfaces, will contribute to Bitcoin’s mass adoption. These advancements are vital in facilitating seamless integration with traditional financial systems and attracting a broader user base.

Regulatory Clarity

As governments around the world formulate clearer regulatory guidelines for cryptocurrencies, Bitcoin’s legitimacy and mainstream acceptance are likely to increase. Regulatory clarity provides a more predictable environment for businesses, investors, and individuals, fostering confidence and fueling market expansion.

Technological Innovation

Ongoing technological advancements, such as the implementation of the Lightning Network and the emergence of layer 2 solutions, aim to address Bitcoin’s scalability and transactional efficiency challenges. These innovations have the potential to enhance Bitcoin’s utility and propel its long-term growth.

Conclusion

Despite concerns over inflation, Bitcoin has demonstrated its resilience as a leading digital asset, maintaining its value above $303,000. The cryptocurrency market continues to evolve, with Bitcoin at the forefront of this transformative movement. As the market matures, regulatory frameworks develop, and technological innovation progresses, Bitcoin’s future prospects remain promising. The ability to withstand inflation worries and the increasing adoption by individuals and institutions position Bitcoin as a cornerstone of the global financial landscape.