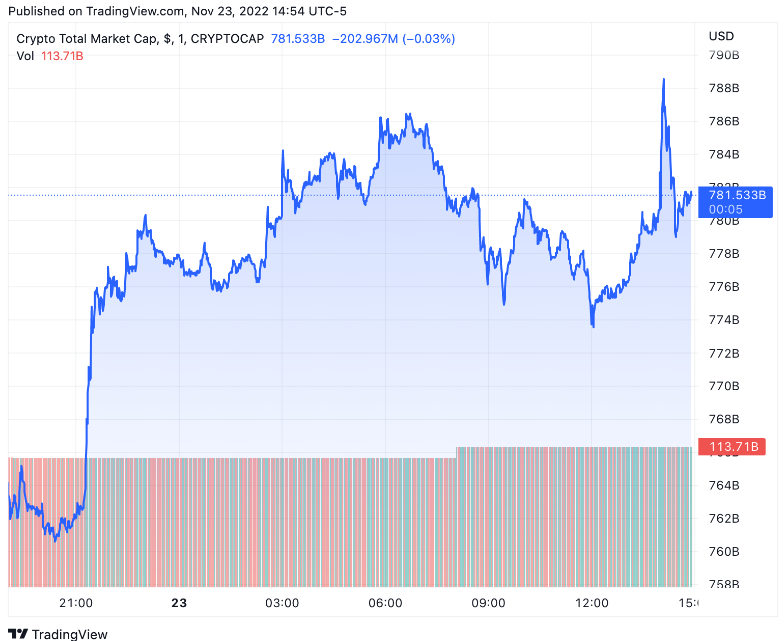

Crypto prices rose and quickly came back down upon the release of the minutes showing that the Fed is going to “slow” down its hikes.

The Federal Open Market Committee (FOMC) — which decides U.S. central bank policy — published minutes from its Nov. 1-2 meeting that revealed a consensus between the committee, with the Board of Governors voting unanimously to raise the interest rate on Nov 2. The committee is in agreement that the Fed needs to slow rate hikes, but less so on the end-point.

Crypto total market cap chart by TradingView

BTC/USD chart by TradingView

DXY chart by TradingView

Following the policy team’s last meeting, the Fed increased interest rates by 75-basis points for the fourth consecutive time. The committee chair and head of the Fed Jerome Powell sent markets into a tizzy in his ensuing press conference. Chair Powell said the ultimate level of rates will be higher than previously expected.

The odds of the FOMC increasing rates by 50 basis points at the meeting on Dec. 14 appear to be 76%, according to the CME’s FedWatch tool.

Source: The Block