Bitcoin turned green Tuesday, coinciding with the news that noted investor Cathie Wood’s Ark Investment Management bought $1.5 million in Grayscale’s Bitcoin Trust (GBTC) shares.

Bitcoin (BTC) was recently trading at about $16,100, up 0.9% in the past 24 hours. The largest cryptocurrency by market capitalization hit a two-year low of $15,480 Monday as jitters over trading firm Genesis’ future loomed over the market.

“It seems crypto traders are already pricing in a bankruptcy for crypto lender Genesis,” Edward Moya, an analyst at foreign-exchange broker Oanda, wrote in a note on Tuesday.

On Monday, Genesis said it had “no plans to file bankruptcy imminently.” The Wall Street Journal, citing people familiar, reported that Genesis sought funding from Binance and Apollo Global Management, and that Binance, the world’s largest crypto exchange by volume, declined to invest, citing potential conflicts of interest. (Genesis’ owner, Digital Currency Group, is also the parent company of CoinDesk.)

Ether (ETH) has followed a similar trajectory to bitcoin, rising roughly 2.5% to $1,120. The CoinDesk Market Index (CMI) was recently up 1.7%.

And yet analysts are giving bearish warnings with crypto markets still digesting the collapse of the FTX exchange that shook the industry.

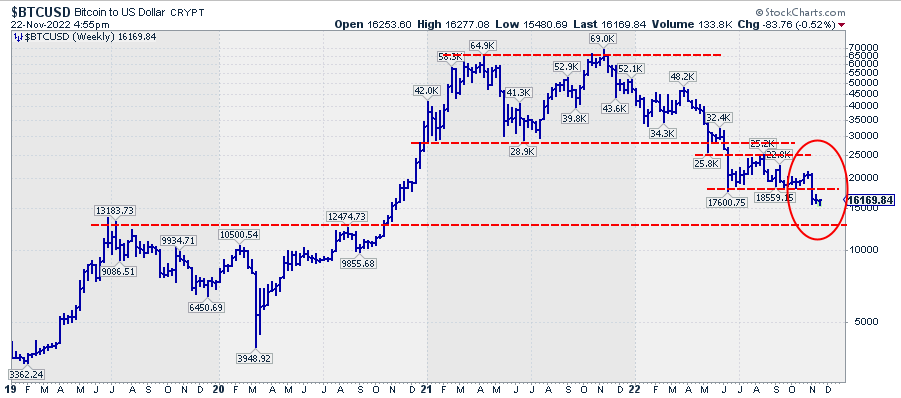

Julius de Kempenaer, senior technical analyst at StockCharts.com, told CoinDesk that as the market is “in digestion,” it’s possible to see BTC drop further – possibly to $12,500 before the end of the year.

According to Kempenaer, big events in markets can go two ways for prices: “It can go to a very rapid decline, market resets as the market digests what’s going on. Or it goes, ‘Market needs time and moves sideways,’ maybe slightly lower.”

The technical chart projects bitcoin’s price could drop further, trading between $12,500 and $18,000. (Julius de Kempenaer, StockCharts.com)

Moya noted that a rebound on Wall Street might provide the support for bitcoin to remain stable but that the scenario “seems unlikely” because the bear market in stocks “has yet to bottom out.”

Meanwhile, Moya wrote, “Bitcoin has support ahead of the $15,500 level, but if that does not hold, technical selling could send prices toward the $13,500 region.”

Source: CoinDesk