TORONTO – A new survey of 1,506 Canadian adults found that nearly 1-in-4 (23.6%) report having invested in, or having planned to investing in real estate or gold to combat the effects of inflation. This comes amid generationally high inflation figures, as more and more Canadians are seeking safer alternatives to cash.

Recent polling data indicates that 85% of Canadians are worried that inflation will make everyday life less affordable. How average Canadians are responding to that threat, however, may signify a paradigm shift in how inflation is addressed by investors moving forward.

The nationwide survey, conducted by Gold RRSP and published on June 20th, 2022, also brings to light that age, geography, and gender have a sizeable impact on how inflation is addressed by Canadian investors.

British Columbia residents were most likely to invest in real estate as an inflation hedge (17.6%), whereas Atlantic Canadians were most likely to invest in gold (18.9%). Women preferred real estate investing over men (53.2% versus 46.8%), and younger investors aged 35 to 44 were 64% more likely to invest in gold than their older counterparts.

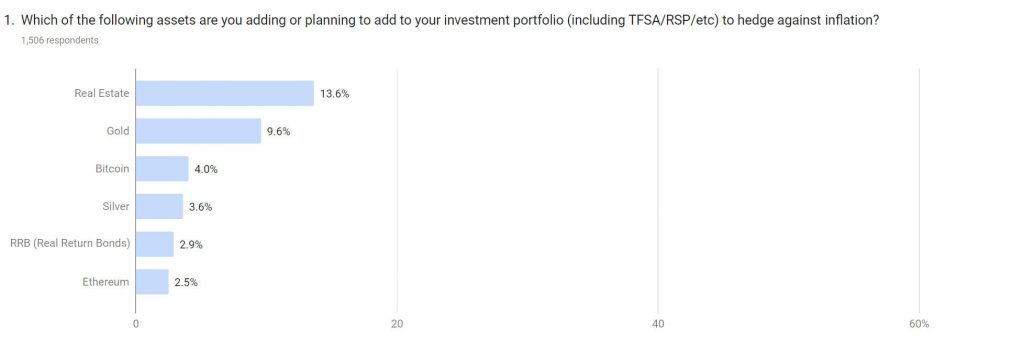

The survey asked a representative, weighted sample of 1,506 Canadian adults aged 35 and over the following question:

“Which of the following assets are you adding or planning to add to your investment portfolio (including TFSA/RRSP, etc.) to hedge against inflation?”

The results found that, for all demographic groups, real estate was the most popular single asset choice for investors (13.6%) to hedge against inflation, followed by precious metals (13.2%; consisting of gold and silver at 9.6% and 3.6%, respectively).

Cryptocurrencies were a distant third choice for Canadians seeking to mitigate the effects of inflation, with 6.5% of Canadians investing in Bitcoin or Ethereum.

On the other hand, more conventional forms of inflation protection, such as real return bonds (RRBs) have largely fallen out of favor among Canadian investors. Only 2.9% of Canadians are investing in RRBs to hedge against the declining dollar.

The survey was designed and published by GoldRRSP.ca, a free personal finance education website. Responses were gathered from a nationally-representative sample, spanning every region of Canada, over a 2-day period between May 10 and May 11, 2022, and were published on June 20th.

Financial writer Liam Hunt, one of the study authors, commented on the significance of the findings:

“This new survey indicates that many Canadians are embracing investment strategies and asset classes that aren’t conventionally understood to hedge against inflation. Whereas RRBs and fixed-income assets were once seen as the default form of inflation insurance, so to speak, today we see more and more Canadians allocating some of their wealth to tangible and intangible alternatives, such as real estate, precious metals, and cryptocurrency.

Precious metals and real estate have been a part of over one quarter of Canadians’ investment strategy to mitigate inflationary effects, whereas traditional hedging tools such as RRBs have largely declined in popularity.”

Source: GoldRRSP.ca