Ottawa – The global 5G services market size was accounted at US$ 64.54 billion in 2021. The worldwide 5G services industry is being driven by a rising reliance on machine-to-machine connectivity and an increase in mobile data traffic. 5G services provide a fully mobile environment by increasing the amount of data transmitted over a wireless network based on high frequency and superior antenna technology.

Due to the increased demand for internet subscriptions and the growing demand for high-speed and comprehensive network coverage, the 5G services industry is also expanding. In addition, the integration of 5G services with the internet of things has enabled high-speed data communication in applications such as smart home energy management, resulting in a 5G services market forecast. The increasing demand for high-speed connectivity is propelling the 5G services market forward.

Report Highlights

- On the basis of communication type, enhanced Mobile Broadband (eMBB) segment holds the largest market share in the global 5G services market. The enhanced Mobile Broadband (eMBB) services are the first commercial 5G services to launch as a supplement to evolving 4G internet services, but it will offer far more than just faster download speeds.

- On the basis of vertical, IT & telecom segment holds the largest market share in the global 5G services market. The IT & telecom segment is anticipated to maintain its dominance during the projected period, due to significant investments by big firms in contemporary communication technology.

Scope of the Report

| Report Attributes | Details |

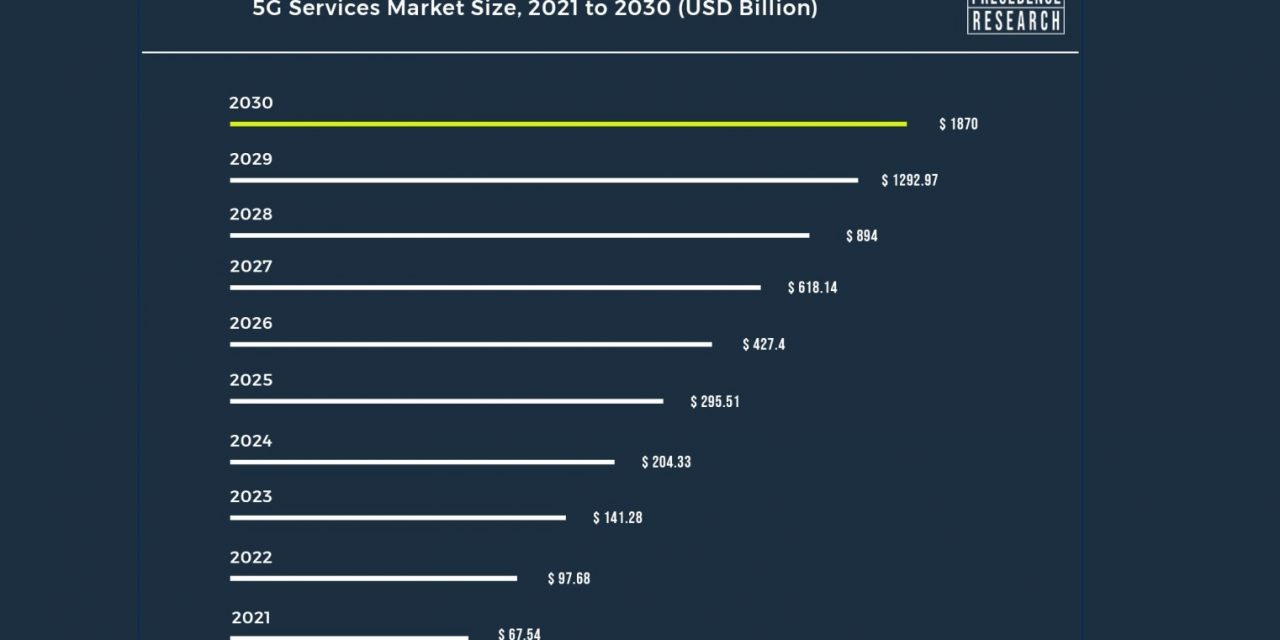

| Market Size in 2021 | USD 65.45 Billion |

| Revenue Forecast by 2030 | USD 1.87 Trillion |

| CAGR | 44.63% from 2022 to 2030 |

| Largest Market | Asia Pacific |

| Companies Covered | SK Telecom Co., Ltd., T-Mobile USA, Inc., Verizon Communications, Inc., Rakuten Mobile Inc., BT Group plc, China Mobile Ltd., AT&T, Inc., China Telecom Corporation Ltd., Saudi Telecom Company, Vodafone Group |

Regional Snapshot

North America is the largest segment for 5G services market in terms of region.The U.S. is dominating the 5G services market in the North America region. The market for 5G services in North America is growing due to rising demand for 5G networks. According to Ericcson’s Mobility Report from June 2019, the region will have over 270 million 5G subscriptions, accounting for roughly 60% of all mobile subscriptions. This indicates that 5G services in the region have a lot of potential.

Asia-Pacific region is the fastest growing region in the 5G services market.China, Japan, and South Korea hold the highest market share in the Asia-Pacific5G services market. The deployment of new and improved technologies is one of the major factors driving the Asia-Pacific 5G services market forward. For the development of the 5G services market in the region, market players are embracing cutting-edge technologies like blockchain, edge computing, and 5G core technology. Furthermore, the growth and development of the 5G services market are aided by the expansion of the information technology sector.

Market Dynamics

Drivers

Growing number of internet of things devices

The high data speed is expected to be driven by the rising demand for edge computing and internet of things devices as well as the growing number of data generated by internet of things devices. 5G services will provide unprecedented data rates while also expanding real time data processing capabilities and enhancing the entire user experience. Thus, growing number of internet of things devices is driving the 5G services market growth.

Restraints

Small cell installations

One of the primary criteria for 5G installations is the cost effective and quick installations of tiny cell networks. Nevertheless, tiny cell installations in many parts of the globe face enormous financial, regulatory, and administrative burdens, further delaying the adoption of 5G technology. As a result, small cell installations are restricting the expansion of worldwide 5G services market.

Opportunities

Growing need for broadband networks

To meet the growing demand and need for mobile broadband services, network capacity must be raised by utilizing new frequency, resulting in widespread acceptance and adoption of the 5G core for the deployment of 5G technology for better mobile broadband services. As a result, growing need for broadband networks is creating lucrative opportunities for the growth of global 5G services market.

Challenges

High installation cost of 5G network

The needed throughput density, base station, and periodic interest rate pricing all have an impact on the cost of 5G infrastructure. For efficient and hyper small cell deployments, lowering these costs is critical. The network connectivity also requires high investments. IDC estimates that investments in smart city technology would reach $135 billion by 2021. Thus, high installation cost of 5G network is the biggest challenge for the growth of global 5G services market.

Recent Developments

- China Mobile and Nokia collaborated in January 2021 to successfully experiment artificial intelligence powered RANs to estimate frequency traffic and identify network anomalies in order to improve the 5G-RAN architecture.

- Nokia teamed with Setar, an Aruba-based communications provider, in December 2019 to enable a complete end to end 5G network transformation. Nokia will modernize core and data management systems as well as improve RAN access. In LAMEA, this is Nokia’s first end to end 5G deal.

- T-Mobile, Nokia, and Ericsson announced a 5-multibillion dollar contract in January 2021 to continue evolving and covering the country’s largest 5G network.

Market Segmentation

By Communication Type

- FWA

- eMBB

- uRLLC

- mMTC

By Vertical

- Manufacturing

- Public Safety

- Healthcare & Social Work

- Media & Entertainment

- Energy & Utility

- IT & Telecom

- Transportation & Logistics

- Aerospace& Defense

- BFSI

- Government

- Retail

- Mining

- Oil & Gas

- Agriculture

- Construction

- Real Estate

By End Users

- Consumers

- Enterprises

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Source: Precedence Research

![Chatbot Market Size [2020-2027] Exhibits 22.5% CAGR to Reach USD 1953.3 Million](https://blocktechfn.com/wp-content/uploads/2022/08/GreenBox-POS-440x264.jpg)