The realm of cryptocurrency is abuzz, particularly following the landmark approval of a Bitcoin ETF. This pivotal moment has sparked a keen interest in Ethereum-based tokens, propelling their values to new heights. Ethereum, in its own right, has witnessed a historic peak, the likes of which haven’t been seen since May 2022. The investor community is buoyed by the prospect of an Ethereum (ETH) ETF getting the nod from the SEC, a factor driving this positive trend.

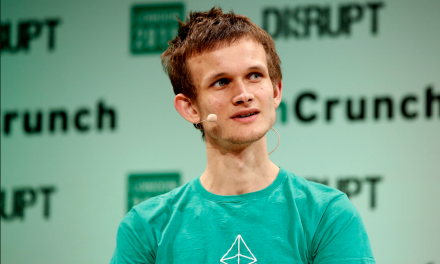

The excitement is further amplified by Vitalik Buterin’s recent proposal to expand the gas limit for Ethereum. This move has seen Ethereum’s value break the $2,600 barrier, a first since May 2022, setting the stage for a potential rise to the $3,000 mark.

A technical examination using Bollinger Bands on a daily timeframe corroborates this bullish sentiment. Ethereum’s current trading value stands at $2,655, having surpassed the upper Bollinger Band of $2,539. This indicates a bullish shift in market dynamics.

For Ethereum’s price to reach the projected $3,000 milestone, it must first navigate through a significant hurdle: the psychological barrier near $2,800. Crossing this threshold could be the key to achieving the $3,000 target.

MEXC Research’s compilation of market insights points to a robust growth in Ethereum markets, spurred by intense buying interest. This trend hints at a possible widespread upward movement in the broader cryptocurrency market, with Ethereum likely to reap major benefits.

Various experts have shared their predictions for Ethereum’s 2024 price trajectory:

Anthony Sano’s bullish forecast pegs Ethereum at an ambitious $10,000 by 2024, citing the allure of Ethereum’s staking feature and the potential introduction of an Ethereum ETF attracting institutional investors.

Rekt Capital anticipates a 22% increase, envisioning Ethereum breaking past the $2,600 mark, provided it maintains solid support at $2,274.

FieryTrading points to a sustained bullish trend over 1.5 years, projecting Ethereum could hit $5,000 by late 2024 or early 2025.

Nikolaos Panigirtzoglou, JPMorgan’s Managing Director, takes a long-term stance, foreseeing Ethereum potentially reaching $8,000 by 2026, with a notable performance possibly eclipsing Bitcoin in 2024, especially with the “Protodanksharding” upgrade.

Michaël van de Poppe predicts a correction to around $1,900, followed by a climb to between $3,400 and $3,800 in early 2024.

Credible Crypto’s ambitious outlook suggests Ethereum could hit a minimum of $10,000, potentially soaring to $20,000 in 2024.

Supporting these forecasts, data from Santiment Information reveals a significant uptick in Ethereum accumulation by major holders. The top 150 self-custody wallets now collectively hold a record 56.25 million ETH, indicating strong confidence in Ethereum’s future prospects.

Summarizing, Ethereum’s price predictions for 2024, as outlined by MEXC Research, range from a conservative $6,000 to an impressive $10,000. These predictions are largely influenced by the market sentiment and the much-anticipated Ethereum ETF.